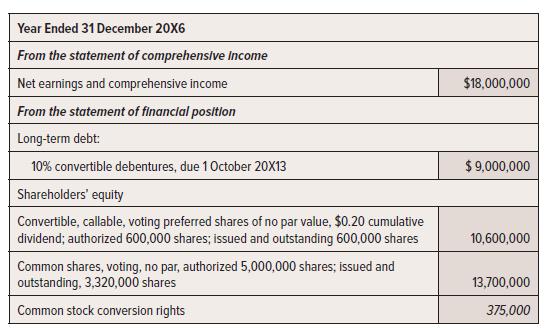

The following data relate to Freeman Inc.: From the disclosure notes: The $0.20 convertible preferred shares

Question:

The following data relate to Freeman Inc.:

From the disclosure notes:

• The $0.20 convertible preferred shares are callable by the company after 31 March 20X14, at $60 per share. Each share is convertible into one common share.

• Options to acquire 500,000 common shares at $53 per share were outstanding during 20X6.

Additional information:

a. Cash dividends of 12.5 cents per common share were declared and paid each quarter.

b. The 10% convertible debentures with a principal amount of $10,000,000 due 1 October 20X13 were issued 1 October 20X3. A discount was originally recorded, and discount amortization was $20,000 in the current year. Each $100 debenture is convertible into two common shares. On 31 December 20X6, ten thousand $100 debentures with a total face value of $1,000,000 were converted to common shares. Interest was paid to the date of conversion, but the newly issued common shares did not qualify for the 31 December common dividend.

c. The 600,000 convertible preferred shares were issued for assets in a purchase transaction in 20X4. The dividend was declared and paid on 15 December 20X6. Each share is convertible into one common share.

d. Options to buy 500,000 common shares at $53 per share for a period of five years were issued along with the convertible preferred shares mentioned in (c).

e. At the end of 20X5, 3,300,000 common shares were outstanding. On 31 December 20X6, 20,000 shares were issued on the conversion of bonds.

f. A tax rate of 40% is assumed.

g. Common shares traded at an average market price of $75 during the year.

Required:

Calculate all EPS disclosures.

Step by Step Answer: