At December 31, 2023, Glover Corporation provided you with the following information: Determine the account and its

Question:

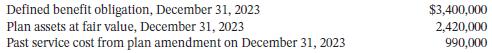

At December 31, 2023, Glover Corporation provided you with the following information:

Determine the account and its balance that should be reported on Glover’s December 31, 2023 balance sheet if it applies ASPE. How should the $990,000 be reported?

Transcribed Image Text:

Defined benefit obligation, December 31, 2023 Plan assets at fair value, December 31, 2023 Past service cost from plan amendment on December 31, 2023 $3,400,000 2,420,000 990,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

The past service cost of 990000 from the 2023 plan amendment has already been include...View the full answer

Answered By

Shivani Dubey

Hello guys, I am very good with the Advance mathematics, Calculus, Number theory, Algebra, Linear algebra, statistics and almost all topics of mathematics. I used to give individual tutoring students in offline mode but now want to help students worldwide so I am joining here. I can also give solutions in various coding languages of mathematics and software like mathematica, R, Latex, Matlab, Statistica, etc.

feel free to ask any doubt regarding mathematics

5.00+

2+ Reviews

10+ Question Solved

Related Book For

Intermediate Accounting Volume 2

ISBN: 9781119740445

13th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy

Question Posted:

Students also viewed these Business questions

-

At December 31, 2020, Glover Corporation provided you with the following information: Defined benefit obligation, December 31, 2020........................................$3,400,000 Plan assets at...

-

At December 31, 2013, Glover Corporation has the following balances: Accrued benefit obligation..........................$3,400,000 Plan assets at fair value................................2,420,000...

-

You work for a company named MCI and you have been assigned the job of adjusting the companys Allowance for Doubtful Accounts balance. You obtained the following aged listing of customer account...

-

McGuire Industries prepares budgets to help manage the company. McGuire is budgeting for the fiscal year ended January 31, 2021. During the preceding year ended January 31, 2020, sales totaled $9,200...

-

Shadow Corp. has no debt but can borrow at 8 percent. The firms WACC is currently 11 percent, and the tax rate is 35 percent. a. What is Shadows cost of equity? b. If the firm converts to 25 percent...

-

Upon graduating from college 35 years ago, Dr. Nick Riviera was already thinking of retirement. Since then he has made deposits into his retirement fund on a quarterly basis in the amount of $ 300....

-

What are the factors to consider in deciding whether a fast or slow approach to change is best? What are the factors to consider in deciding whether a top-down or participatory approach to change is...

-

Reporting Multipurpose Grant Transactions in the Funds and Governmentwide Financial Statements of Local Government Recipients. In this case local governments receive reimbursements from the state...

-

Subsequent events are often issues that may cause a conflict between the management of the company and the auditor. Explain the reason(s) for this conflict and describe the steps that the auditor...

-

In cryptography, cipher text is encrypted or encoded text that is unreadable by a human or computer without the proper algorithm to decrypt it into plain text. The impact of erroneous cipher texts on...

-

Monday Corporation sponsors a defined benefit pension plan and reports under IFRS. On January 1, 2023, the company reported plan assets of $1,000 and a defined benefit obligation of $1,100 (all...

-

Maya Corp. reports the following information (in hundreds of thousands of dollars) to you about its defined benefit pension plan for 2023: Provide a continuity schedule for the DBO for the year. Maya...

-

Given the table in the previous question, how many of the boxes in the Intermediate Operation column will have the pipeline complete regardless of which intermediate operation is placed in the box?...

-

Adidas-Consumer Goods STEP ONE: MISSION: Mission statement core message that guides and influences your marketing strategy. Why is this company in business and what is the purpose of their...

-

You have been operating and growing your golf club for the last six (6) years. You are happy with the fact that all revenue streams (and as a result your share value) have continued to increase as...

-

Given the following HTML, write a simple bit of JavaScript code that will DELETE ALL OF THE TAGS ON THE PAGE. Quiz I'm a Heading I'm a paragraph I'm special I'm also a paragraph Footer! HINT: You'll...

-

Your company has been quite successful in sending employees on international assignments. As the HR Manager responsible for selecting such employees, present a report to the management of your...

-

You will be looking at a particular market in the economy. I will assign the market to you arbitrarily. Please look for at the end of this document to identify which market you will be responsible...

-

Gorham, Inc., a manufacturer of plastic products, reports the following manufacturing costs and account analysis classification for the year ended December 31, 2012. Gorham, Inc., produced 72,500...

-

A. Select a recent issue (paper or online) of Report on Business Magazine, Canadian Business Magazine (online only), Bloomberg Businessweek, Fast Company, The Economist, or another business magazine....

-

Blue and White Town Taxi Incorporated applied for several taxi licences for its taxicab operations in the Town of Somerville and, on August 31, 2020, incurred costs of $12,500 in the application...

-

At the end of 2020, Dayton Corporation owns a licence with a remaining life of 10 years and a carrying amount of $530,000. Dayton expects undiscounted future cash flows from this licence to total...

-

Repeat E12.13, but now assume that Dayton prepares financial statements in accordance with ASPE, and that the recoverable amount under ASPE (undiscounted future cash flows) is calculated to be...

-

Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five - year period. His annual pay raises are determined by his division s...

-

Consider a 5 year debt with a 15% coupon rate paid semi-annually, redeemable at Php1,000 par. The bond is selling at 90%. The flotation cost is Php50 per bind. The firm's tax bracket is 30%.

-

A project will generate annual cash flows of $237,600 for each of the next three years, and a cash flow of $274,800 during the fourth year. The initial cost of the project is $749,600. What is the...

Study smarter with the SolutionInn App