Brubacher Corporations post-closing trial balance at December 31, 2023, was as follows: At December 31, 2023, Brubacher

Question:

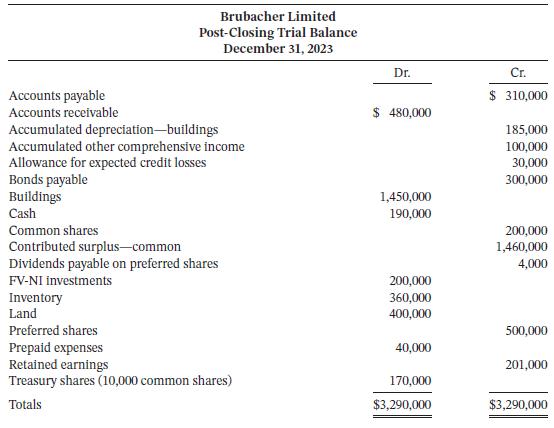

Brubacher Corporation’s post-closing trial balance at December 31, 2023, was as follows:

At December 31, 2023, Brubacher had the following numbers for its common and preferred shares:

The dividends on preferred shares are $5 cumulative. In addition, the preferred shares have a preference in liquidation of $50 per share.

InstructionsPrepare the shareholders’ equity section of Brubacher’s SFP at December 31, 2023. The company follows IFRS.

Accounts payable Accounts receivable Brubacher Limited Post-Closing Trial Balance December 31, 2023 Accumulated depreciation-buildings Accumulated other comprehensive income Allowance for expected credit losses Bonds payable Buildings Cash Common shares Contributed surplus-common Dividends payable on preferred shares FV-NI investments Inventory Land Preferred shares Prepaid expenses Retained earnings Treasury shares (10,000 common shares) Totals Dr. $ 480,000 1,450,000 190,000 200,000 360,000 400,000 40,000 170,000 $3,290,000 Cr. $ 310,000 185,000 100,000 30,000 300,000 200,000 1,460,000 4,000 500,000 201,000 $3,290,000

Step by Step Answer:

Share Capital Brubacher Limited Shareholders Equity Decemb...View the full answer

Intermediate Accounting Volume 2

ISBN: 9781119740445

13th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

Brubacher Corporations post-closing trial balance at December 31, 2012, was as follows: At December 31, 2012, Brubacher had the following numbers for its common and preferred shares: The dividends on...

-

Brubacher Corporation's post-closing trial balance at December 31, 2017 was as follows: At December 31, 2017, Brubacher had the following numbers for its common and preferred shares: The dividends on...

-

Brubacher Corporation's post-closing trial balance at December 31, 2020, was as follows: At December 31, 2020, Brubacher had the following numbers for its common and preferred shares: The dividends...

-

Let (x) = x - 3, g(x) = x, h(x) = x 3 , and j(x) = 2x. Express each of the functions as a composite involving one or more of , g, h, and j. a. y = x - 3 b. y = 2x c. y = x 1/4 d. y = 4x e. y = (x -...

-

Briley, Inc., is expected to pay equal dividends at the end of each of the next two years. Thereafter, the dividend will grow at a constant annual rate of 4 percent, forever. The current stock price...

-

Which retailers have the strongest image and equity in your mind? Think about the brands they sell. Do they help to contribute to the equity of the retailer? Conversely, how does that retailers image...

-

Go to www.nu-solutions.com/downloads/earned_.. value_lite.pdf and access the article by Q. W. Fleming and J. M. Koppelman, Earned Value Lite: Earned Value for the Masses. From your reading, summarize...

-

Summer Tyme, Inc., is considering a new three-year expansion project that requires an initial fixed asset investment of $3.9 million. The fixed asset will be depreciated straight-line to zero over...

-

You own a stock portfolio invested 32 percent in Stock Q, 22 percent in Stock R, 19 percent in Stock S, and 27 percent in Stock T. The betas for these four stocks are 1.17, 1.08, 1.55, and 1.24,...

-

Ellie has won a lottery. The lottery offers to payment plans. Ellie is trying to decide which one of two he should accept. Project 1 will pay $48,000 a year for 8 years. Project 2 will pay $52,000 a...

-

The treasurer of Hing Wa Corp. has read that the stock price of Ewing Inc. is about to take off. To profit from this potential development, Hing Wa purchased a call option on Ewing common shares on...

-

Cornwall Inc., a publicly accountable enterprise that reports in accordance with IFRS, issued convertible bonds for the first time on January 1, 2023. The $1 million of six-year, 10% (payable...

-

(Various budgets) The following are four independent situations. a. Bryan Frozen Foods is planning to produce two products: frozen dinners and frozen desserts. Sales of frozen dinners are expected to...

-

Solve the Differential equation. xydx+dy=0

-

What is Hue and saturation?

-

Explain traversing on the following parcel.Provide one numerical example.

-

Explore the role of post-occupancy evaluation in commercial and industrial architecture. How do architects use feedback from building users to improve future designs?

-

Analyze the impact of sustainable construction on biodiversity and ecosystem services. How can construction practices be adapted to minimize impacts on local ecosystems and enhance biodiversity?

-

What is included in the standard rate per hour for direct labour?

-

Independent random samples of sizes n1 = 30 and n2 = 50 are taken from two normal populations having the means 1 = 78 and 2 = 75 and the variances 21 = 150 and 22 = 200. Use the results of Exercise...

-

Geoff Corp.'s operations in 2020 had mixed results. One division, Vincenti Group, again failed to earn income at a rate that was high enough to justify its continued operation, and management...

-

Refer to the information in BE18.11 for Henry Limited. Assume that the company reports under ASPE and that the taxes payable method of accounting is used for income tax. Instructions a. Prepare the...

-

Refer to the information in BE18.15 for Zdon Inc. Assume that the company follows the taxes payable method of accounting for income taxes under ASPE. During the year, Zdon Inc. made tax instalment...

-

Question 24 Not yet answered Marked out of 1.00 P Flag question Muscat LLC's current assets and current liabilities are OMR 258,000 and OMR 192,000, respectively. In the year 2020, the company earned...

-

Question 24 Miami Company sold merchandise for which it received $710,400, including sales and excise taxes. All of the firms sales are subject to a 6% sales tax but only 50% of sales are subject to...

-

f the IRS intends to close a Taxpayer Assistance Center, they must notify the public at least _____ days in advance of the closure date. 14 30 60 90

Study smarter with the SolutionInn App