Clarkson Inc. purchased (10 %) of the 10,000 shares of common stock in Nashville Inc. for ($

Question:

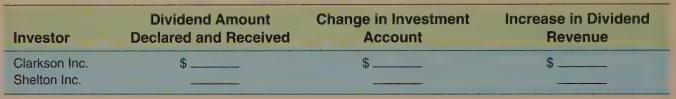

Clarkson Inc. purchased \(10 \%\) of the 10,000 shares of common stock in Nashville Inc. for \(\$ 40,000\) in January 2020. Shelton Inc. purchased 35\% of the 10,000 shares of common stock in Nashville Inc. for \(\$ 140,000\) in January 2020. In December 2020, Nashville Inc. declared and paid a dividend of \(\$ 1\) per share on its outstanding shares of common stock. For each investor, determine the dividend amount received, and the related impact on the Investment and Dividend Revenue accounts. Assume that Shelton Inc. (but not Clarkson Inc.) has significant influence over Nashville Inc.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting Volume 2

ISBN: 9781618533135

2nd Edition

Authors: Hanlon, Hodder, Nelson, Roulstone, Dragoo

Question Posted: