(Completed Contract and Percentage of Completion with Interim Loss) Gold Medal Custom Builders (GMCB) was established in...

Question:

(Completed Contract and Percentage of Completion with Interim Loss) Gold Medal Custom Builders (GMCB) was established in 1985 by Whitney Hedgepeth and initially built high-quality customized homes under contract with specific buyers. In the 1990s, Hedgepeth’s two sons joined the firm and expanded GMCB’s activities into the high-rise apartment and industrial plant markets. Upon the retirement of GMCB’s long-time financial manager, Hedgepeth’s sons recently hired Le Jingyi as controller for GMCB. Jingyi, a former college friend of Hedgepeth’s sons, has been associated with a public _ accounting firm for the last 6 years.

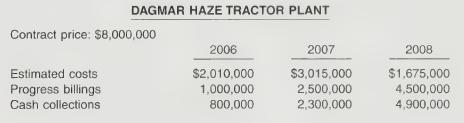

Upon reviewing GMCB’s accounting practices, Jingyi observed that GMCB followed the completedcontract method of revenue recognition, a carryover from the years when individual home building was the majority of GMCB’s operations. Several years ago, the predominant portion of GMCB’s activities shifted to the high-rise and industrial building areas. From land acquisition to the completion of construction, most building contracts cover several years. Under the circumstances, Jingyi believes that GMCB should follow the percentage-of-completion method of accounting. From a typical building contract, Jingyi developed the following data.

Instructions

(a) Explain the difference between completed-contract revenue recognition and_percentageof-

completion revenue recognition.

(b) Using the data provided for the Dagmar Haze Tractor Plant and assuming the percentageof-

completion method of revenue recognition is used, calculate GMCB’s revenue and gross profit for 2006, 2007, and 2008, under each of the following circumstances.

(1) Assume that all costs are incurred, all billings to customers are made, and all collections from customers are received within 30 days of billing, as planned.

(2) Further assume that, as a result of unforeseen local ordinances and the fact that the building site was in a wetlands area, GMCB experienced cost overruns of $800,000 in 2006 to bring the site into compliance with the ordinances and to overcome wetlands barriers to construction.

(3) Further assume that, in addition to the cost overruns of $800,000 for this contract incurred under part (b)2, inflationary factors over and above those anticipated in the development of the original contract cost have caused an additional cost overrun of $540,000 in 2007. It is not anticipated that any cost overruns will occur in 2008.

Step by Step Answer:

Intermediate Accounting 2007 FASB Update Volume 2

ISBN: 9780470128763

12th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield