(Computation of Pension Expense, Amortization of Net Gain or LossCorridor Approach, Journal Entries for 3 Years) Dubel...

Question:

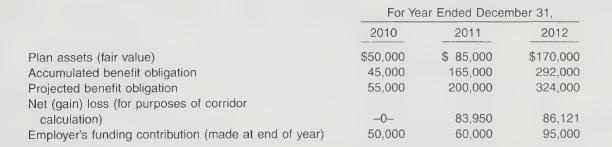

(Computation of Pension Expense, Amortization of Net Gain or Loss—Corridor Approach, Journal Entries for 3 Years) Dubel Toothpaste Company initiates a defined benefit pension plan for its 50 employees on January 1, 2010. The insurance company which administers the pension plan provided the following selected information for the years 2010, 2011, and 2012.

There were no balances as of January 1, 2010, when the plan was initiated. The actual and expected return on plan assets was 10% over the 3-year period but the settlement rate used to discount the company’s pension obligation was 13% in 2010, 11% in 2011, and 8% in 2012. The service cost component of net periodic pension expense amounted to the following: 2010, $55,000; 2011, $85,000; and 2012, $119,000. The average remaining service life per employee is 12 years. No benefits were paid in 2010, $30,000 of benefits were paid in 2011, and $18,500 of benefits were paid in 2012 (all benefits paid at end of year).

Instructions (Round to the nearest dollar)

(a) Calculate the amount of net periodic pension expense that the company would recognize in 2010, 2011, and 2012.

(b) Prepare the journal entries to record net periodic pension expense, employer's funding contribution, and related pension amounts for the years 2010, 2011, and 2012.

Step by Step Answer:

Intermediate Accounting 2007 FASB Update Volume 2

ISBN: 9780470128763

12th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield