Early in 20X1, Nitro Demolition Ltd. borrowed money to partially finance the acquisition of a bulldozer. The

Question:

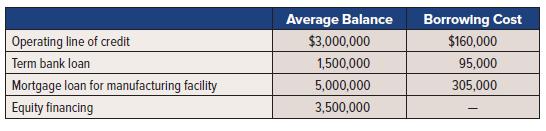

Early in 20X1, Nitro Demolition Ltd. borrowed money to partially finance the acquisition of a bulldozer. The loan was a five-year, $90,000 loan, secured by a first charge on the bulldozer and the guarantee of the company president. The interest rate was 2%, with interest paid annually at the end of each year. An upfront fee of $15,165 was charged on the loan. The money was borrowed on 15 January, and the bulldozer was ordered and paid for on this date. It was delivered on 30 June 20X1. The invoice price of the equipment was $180,000. It was then customized at a cost of $15,000 in July. Staff training and testing on the equipment was completed in August at a cost of $10,000, and the machine was operational in early September 20X1. In addition to the loan for this equipment, the company had the following capital structure and borrowing costs for the year:

Required:

1. Provide journal entries to record the $90,000 loan on 15 January. What is the effective cost of this financing (round to the nearest whole percent)? How much cash is received?

2. Calculate the total cost of the equipment, including capitalized borrowing costs. Round the percentage cost of general borrowing to two decimal places.

Step by Step Answer: