Fellows Inc. started operations on 1 January 20X8 and purchased $2,000,000 of equipment. The income tax rate

Question:

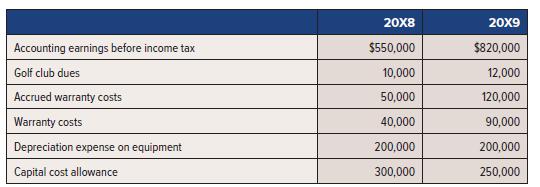

Fellows Inc. started operations on 1 January 20X8 and purchased $2,000,000 of equipment. The income tax rate was 40% in 20X8 and 38% in 20X9. The following is information related to 20X8 and 20X9:

Required:

1. Prepare all income tax journal entries for 20X8 and 20X9.

2. What are the deferred tax balances on the statement of financial position in 20X8 and 20X9?

Accounting earnings before income tax Golf club dues Accrued warranty costs Warranty costs Depreciation expense on equipment Capital cost allowance 20X8 $550,000 10,000 50,000 40,000 200,000 300,000 20X9 $820,000 12,000 120,000 90,000 200,000 250,000

Step by Step Answer:

Requirement 1 Requirement 2 Tax calculations Accounting earnings before income tax Add permanen...View the full answer

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Business questions

-

On January 1, Year 1, Green Inc. purchased 100% of the common shares of Mansford Corp. for $335,000. Greens balance sheet data on this date just prior to this acquisition were as follows: The balance...

-

The following are several transactions of Ardery Company that occurred during the current year and were recorded in permanent (that is, balance sheet) accounts unless indicated otherwise: Date...

-

ALMA.com is an e-commerce service for teenagers' video games, television programs, and other material, intended to be both educational and enjoyable. Valuable product information and detailed review...

-

Misty Cumbie worked as a waitress at the Vita Caf in Portland, Oregon. The caf was owned and operated by Woody Woo, Inc. Woody Woo paid its servers an hourly wage that was higher than the states...

-

Refer to Data Set 10 in Appendix B and use the amounts of nicotine (mg per cigarette) in the king-size cigarettes, the 100-mm menthol cigarettes, and the 100-mm nonmenthol cigarettes. The king-size...

-

Describe TQM and how it works.

-

36. Which tax entity types are generally allowed to use the cash method of accounting?

-

Lyon Center began operations on July 1. It uses a perpetual inventory system. During July, the company had the following purchases and sales. Instructions (a) Determine the ending inventory under a...

-

The statement of income and unclassified statement of financial position for E-Perform, Inc. follow: E-PERFORM, INC. Statement of Financial Position December 31 2021 Assets 2020 Cash $97,800 $48,400...

-

The records of Samuel Corp. provided the following data at the end of years 1 through 4 relating to income tax allocation: The above amounts include only one temporary difference; no other changes...

-

Renat Mehali is a junior accountant, working in the same group as you at your public accounting firm, P&A Partners. Renat looks up to you and often turns to you for guidance and mentorship. Renat is...

-

In what situations is it most likely that auditors will decide to test controls over payroll transactions?

-

The Penguin Textile Company sells shirts for men and boys. Results for January 2 0 2 3 are summarized below. Men's Boy's Total Revenue $ 1 7 2 , 8 0 0 $ 7 2 , 0 0 0 $ 2 4 4 , 8 0 0 Variable costs 1 2...

-

SINGLE, MARRIED FILING SEPERATELY, OR HEAD OF HOUSEHOLD SINGLE, MARRIED FILING SEPERATELY, OR HEAD OF HOUSEHOLD Over $0 $12,500 $50,000 But Not Over $12,500 $50,000 Tax Due Is 4% of taxable income...

-

17. S T D -3 -2 graph of glx) 2 The graph of the continuous function g is shown above for -46x4. The Function g is twice differentiable, except at x=0. let & be the function with flo1=-2 and f'(x) =...

-

Tim works for HydroTech, a manufacturer of high-pressure industrial water pumps. He reports directly to the CFO, and she has asked him to calculate HydroTech's WACC. He has gathered the following...

-

You are appraising a 15,450 square foot (SF) building and using the Cost Approach. The base cost is $50/SF, the local multiplier is 1.05, the current cost multiplier is 0.92. The land value is...

-

Dee Bell Companys records showed the following April 30, 2017, account balances: Required 1. Using the chart of accounts numbering system, assign an account number to each account. 2. Using the...

-

Kenneth Hubbard has prepared the following list of statements about managerial accounting and financial accounting. 1. Financial accounting focuses on providing information to internal users. 2....

-

Financial reporting distinguishes equity into two broad components: contributed capital and accumulated income; the latter is further separated into retained earnings and accumulated other...

-

Which of the following transactions have the potential to directly affect the retained earnings portion of equity? Exclude indirect effects such as the transfer of income into retained earnings at...

-

For accounting purposes, of the following characteristics, which distinguish a common share from a preferred share? Explain your answer briefly. The share has no par value. The share has voting...

-

Based on the regression output (below), would you purchase this actively managed fund with a fee of 45bps ? Answer yes or no and one sentence to explain why.

-

What is the yield to maturity on a 10-year, 9% annual coupon, $1,000 par value bond that sells for $967.00? That sells for $1,206.10?

-

1)Prepare the journal entry to record Tamas Companys issuance of 6,500 shares of $100 par value, 9% cumulative preferred stock for $105 cash per share. 2. Assuming the facts in part 1, if Tamas...

Study smarter with the SolutionInn App