In 20X6, Dalia Corp., a calendar fiscal-year company, discovered that depreciation expense was erroneously overstated $52,000 in

Question:

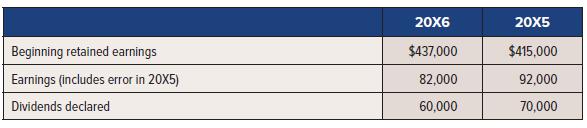

In 20X6, Dalia Corp., a calendar fiscal-year company, discovered that depreciation expense was erroneously overstated $52,000 in both 20X4 and 20X5 for financial reporting purposes. Net income in 20X6 is correct. The tax rate is 35%. The error was made only for financial reporting, affecting depreciation and deferred income tax accounts. CCA had been recorded correctly, and thus there will be no change in taxes payable. Additional information:

Required:

1. Record the entry in 20X6 to correct the error.

2. Prepare the comparative retained earnings section of the statement of changes in shareholders’ equity for 20X5, reflecting the change.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel