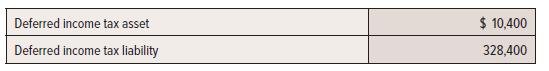

Kong Corp. reported the following items with respect to income tax in the 20X6 financial statements: The

Question:

Kong Corp. reported the following items with respect to income tax in the 20X6 financial statements:

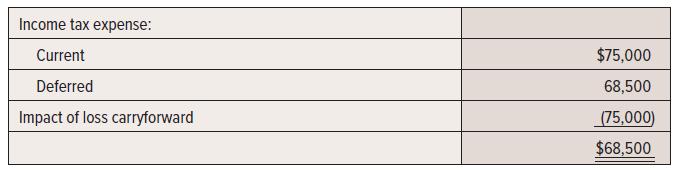

The 20X6 statement of comprehensive income shows the following income tax expense:

The disclosure notes indicate that there is an unrecognized loss carryforward in the amount of

$406,400. No tax loss carryforwards have been recorded as assets. The tax rate is 40%.

Required:

1. Explain the components of the 20X6 income tax expense. Why is there income tax expense if there is a loss carryforward?

2. Give an example of a statement of financial position account that could have caused a deferred income tax asset and a deferred income tax liability. Why are these two accounts not netted on the SFP?

3. Why would the loss carryforward not have been recognized in its entirety in 20X6? What amounts and accounts would change if it could be recognized?

4. How much tax is currently payable? How much tax would have been payable if there had been no loss carryforward?

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel