Burgher Ltd. had a taxable loss of $300,000 in 20X7. The tax rate in 20X7 is 32%.

Question:

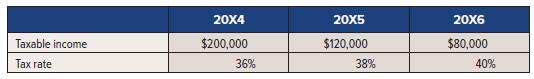

Burgher Ltd. had a taxable loss of $300,000 in 20X7. The tax rate in 20X7 is 32%. In the past three years, the company had the following taxable income and tax rates:

There are no temporary differences other than those created by income tax losses.

Required:

1. What is the amount of refund that will be claimed in 20X7, taking the loss back to the oldest possible year, first? Provide the journal entry for income tax receivable in 20X7.

2. Is there a different pattern for claiming a refund that will maximize cash flows for the company? Recalculate the refund and provide the journal entry using this alternate pattern.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel