Petrilli Ltd. had a taxable loss of $3,500,000 in 20X8 and a further loss of $100,000 in

Question:

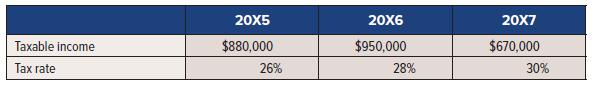

Petrilli Ltd. had a taxable loss of $3,500,000 in 20X8 and a further loss of $100,000 in 20X9. The tax rate in 20X8 was 32% and in 20X9, 33%. All rates are enacted in the year to which they pertain. In the three years before the losses, the company had the following taxable income and tax rates:

There are no temporary differences other than those created by income tax losses. The company was struggling due to a competitor entering the market.

Required:

1. What is the amount of refund that will be claimed in 20X8?

2. What is the amount of the loss carryforward in 20X8?

3. Assuming that loss carryforward usage is probable in each year, prepare a journal entry for income tax in 20X8 and 20X9.

4. Assuming that loss carryforward usage is not probable in each year, prepare a journal entry for income tax in 20X8 and 20X9.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel