Loo Corp. was incorporated in 20X5. Details of the companys results are presented below: Required: 1. Prepare

Question:

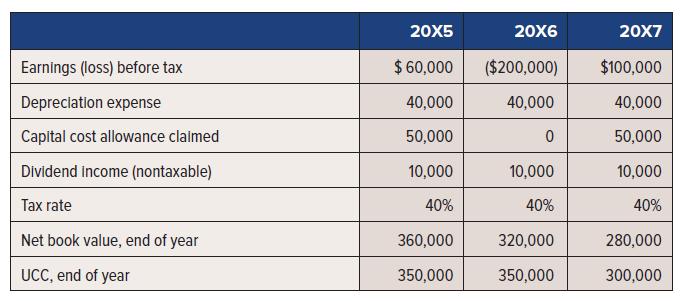

Loo Corp. was incorporated in 20X5. Details of the company’s results are presented below:

Required:

1. Prepare journal entries for tax for 20X5, 20X6, and 20X7. Assume that realization of the benefit of the loss carryforward is probable in 20X6.

2. Repeat requirement 1, assuming that the tax rate is 40% in 20X5 but is changed to 42% in 20X6 and to 44% in 20X7. All tax rates are enacted in the year in which they are effective.

3. Revert to the facts of requirement 1 (i.e., 40% tax rate in each year). Assume that the use of the unused tax loss carryforward is considered to not be probable in 20X6 and is still not probable in 20X7 other than the loss carryforward actually utilized in 20X7. Provide journal entries for 20X5, 20X6, and 20X7.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel