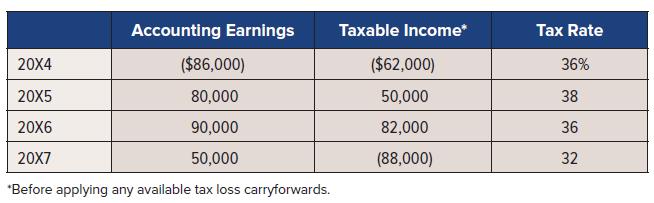

Lu Ltd. has experienced the following accounting earnings and taxable income: The differences between accounting and taxable

Question:

Lu Ltd. has experienced the following accounting earnings and taxable income:

The differences between accounting and taxable income are caused by differences between accounting and tax expenses that will not reverse (permanent differences). All tax rates are enacted in the year to which they relate.

Required:

1. Record income tax for 20X4 through 20X7 assuming that the future use of tax loss carryforwards is not considered to be probable.

2. Repeat requirement 1, assuming that the use of tax loss carryforwards is considered to be probable in the loss year.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel

Question Posted: