Neilson Tool Corporations December 31 year-end financial statements contained the following errors: An insurance premium of $66,000

Question:

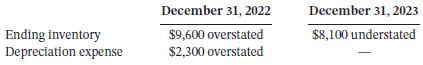

Neilson Tool Corporation’s December 31 year-end financial statements contained the following errors:

An insurance premium of $66,000 covering the years 2022, 2023, and 2024 was prepaid in 2022, with the entire amount charged to expense that year. In addition, on December 31, 2023, fully depreciated machinery was sold for $15,000 cash, but the entry was not recorded until 2024. There were no other errors during 2022 or 2023, and no corrections have been made for any of the errors. Neilson follows ASPE.

Instructions

Answer the following, ignoring income tax considerations.

a. Calculate the total effect of the errors on 2023 net income.

b. Calculate the total effect of the errors on the amount of Neilson’s working capital at December 31, 2023.

c. Calculate the total effect of the errors on the balance of Neilson’s retained earnings at December 31, 2023.

d. Assume that the company has retained earnings on January 1, 2022 and 2023, of $1,250,000 and $1,607,000, respectively; net income for 2022 and 2023 of $422,000 and $375,000, respectively; and cash dividends declared for 2022 and 2023 of $65,000 and $45,000, respectively, before adjustment for the above items. Prepare a revised statement of retained earnings for 2022 and 2023.

e. Outline the accounting treatment required by ASPE in this situation and explain how these requirements help investors.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119740445

13th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy