Notting Hill Limited reported the following amounts on the 31 December 20X2 SFP: Notting Hill has material

Question:

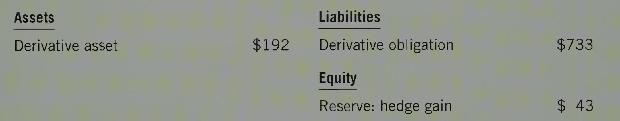

Notting Hill Limited reported the following amounts on the 31 December 20X2 SFP:

Notting Hill has material accounts receivable and purchase orders that are denominated in U.S. dollars. The company follows a policy of hedging all exchange exposure with futures contracts.

Required:

1. Explain how futures contracts can be used to hedge exchange exposure caused by U.S. dollar accounts receivable.

2. Explain the conditions that cause a derivative instrument to be an asset or a liability.

3. Are gains and losses from derivatives included in earnings? Explain.

4. What conditions must be met for hedge accounting to be invoked?

5. What is the most likely explanation for the presence of the \(\$ 43\) hedge reserve?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: