On January 1 of each of the first four years of its existence, Allway Company purchases a

Question:

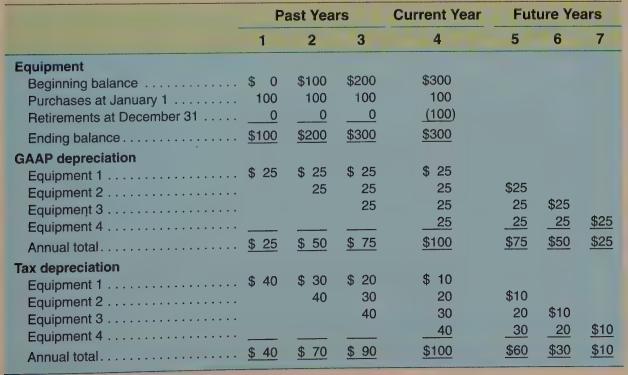

On January 1 of each of the first four years of its existence, Allway Company purchases a new unit of equipment. Each unit has a four-year life and zero salvage value, costs \(\$ 100,000\), and is depreciated for GAAP and tax purposes as shown below. The income tax rate is \(25 \%\). Allway has a deferred tax liability of \(\$ 12,500\) at the end of year 3. The current year is year 4 , and pretax GAAP income is \(\$ 30,000\). Amounts are in thousands.

Required

a. Record the income tax entry at the end of year 4.

b. Assume that during year 4 the tax rate is increased to \(30 \%\) effective as of the beginning of year 4. Repeat

(a) under this assumption.

c. Assume that during year 4 the tax rate is increased to \(30 \%\) effective in year 5 and to \(35 \%\) thereafter. Repeat

(a) under this assumption.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781618533135

2nd Edition

Authors: Hanlon, Hodder, Nelson, Roulstone, Dragoo