Stacy Corp. would have had identical income before tax on both its income tax returns and statements

Question:

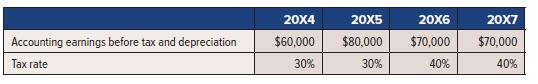

Stacy Corp. would have had identical income before tax on both its income tax returns and statements of profit and loss for the years 20X4 through 20X7, except for equipment that cost $120,000. The equipment has a four-year estimated life and no residual value. The equipment was depreciated for income tax purposes using the following amounts: 20X4, $48,000; 20X5, $36,000; 20X6, $24,000; and 20X7, $12,000. However, for accounting purposes, the straight-line method was used (i.e., $30,000 per year). The accounting and tax periods both end on 31 December. Income amounts before depreciation expense and income tax for each of the four years were as follows:

Required:

1. Explain why this is a temporary difference.

2. Calculate the accounting carrying value and tax basis of the equipment at the end of each year.

3. Reconcile pre-tax accounting and taxable income, calculate income tax payable and tax expense, compute the balance in the deferred income tax account, and prepare journal entries for each year-end.

Step by Step Answer: