Golf Inc., which began operations in 20X3, uses the same policies for financial accounting and tax purposes

Question:

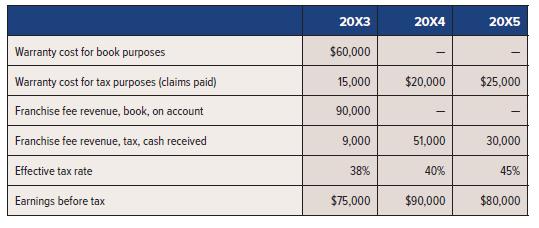

Golf Inc., which began operations in 20X3, uses the same policies for financial accounting and tax purposes with the exception of warranty costs and franchise fee revenue. Information about the $60,000 of warranty expenses and $90,000 franchise revenue accrued for book purposes is provided below:

Required:

Prepare journal entries to record taxes for 20X3 to 20X5. The tax rate for a given year is not enacted until that specific year.

Warranty cost for book purposes Warranty cost for tax purposes (claims paid) Franchise fee revenue, book, on account Franchise fee revenue, tax, cash received Effective tax rate Earnings before tax 20X3 $60,000 15,000 90,000 9,000 38% $75,000 20X4 $20,000 51,000 40% $90,000 20X5 $25,000 30,000 45% $80,000

Step by Step Answer:

Earnings before tax Timing differences Warranty expense tax deduction Franchise accounting fee reven...View the full answer

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Business questions

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

Start of Payroll Project 7-3a October 9, 20-- No. 1 The first payroll in October covered the two workweeks that ended on September 26 and October 3. This payroll transaction has been entered for you...

-

The first payroll in October covered the two workweeks that ended on September 26 and October 3. This payroll transaction has been entered for you in the payroll register, the employees' earnings...

-

Julia Robertson is a senior at Tech, and she's investigating different ways to finance her final year at school. She is considering leasing a food booth outside the Tech stadium at home football...

-

Suppose that A 1 , A2 , and B are events where A1 and A2 are mutually exclusive and P(A1 ) =.8 P( B A1 )= .1 P( A2 ) =.2 P( B A2 )= .3 Use this information to find P (A1 B) and P (A2 B).

-

The key initial element in developing all pro forma statements is: O a. a cash budget. b. an income statement. O c. a sales forecast. d. a collections schedule

-

A company does an ABC analysis of its inventory and calculates that out of 5000 items 22% can be classified as A items, 33% as B items, and the remainder as C items. A decision is made that A items...

-

1. Assume that a third party(ies) is considering whether to sue the external auditors of QSGI. What could they allege in their lawsuit and why? 2. Assuming a third party(ies) files the lawsuit, what...

-

Pineapple Co. is considering a project with an initial cost of $4 million. The project will produce cash inflows of $2 million a year for five years. The firm has a weighted average cost of capital...

-

Stacy Corp. would have had identical income before tax on both its income tax returns and statements of profit and loss for the years 20X4 through 20X7, except for equipment that cost $120,000. The...

-

At the end of 20X8, Bent Angel Ltd.s statement of financial position showed equipment at total cost of $2,000,000. The equipment was being amortized at 10% per year, straight-line, and was 40%...

-

Calculate the expected yield for the following securities using current information and the framework of the CAPM: BlackBerry, Teck, Talisman, Potash, and the S&P /TSX Composite Index. For the market...

-

Year 5% 6% 4 3.546 3.465 5 7% 3.387 3.312 4.329 4.212 4.100 8% 3.993 5.076 4.917 4.767 4.623 Present Value of an Annuity of $1 at Compound Interest 9% 10% 11% 12% 13% 14% 15% 3.240 3.170 3.102 3.037...

-

2. Determine the overturning stability of the cantilever retaining wall shown. The equivalent fluid density is 5.5 kN/m, soil density is 18 kN/m, and the concrete weighs 23.5 kN/m. (5 pts) 2 m 2 m 2...

-

A. For a certain two-dimensional, incompressible flow field the velocity component in the y direction is given by v = 3xy + xy 1. (05 pts) Short answer, what is the condition for this flow field to...

-

Cho0se a hazardous material to cr3ate a pr3sentation on (i.e. sulfuric acid, explosives, used needles, there are many types of hazardous materials) Cr3ate a presentation (P0werPoint, Open0ffice...

-

If det [a b] = c d 2 -2 0 a. det c+1 -1 2a d-2 2 2b -2 calculate:

-

What diameter should the nichrome wire in FIGURE P27.63 be in order for the electric field strength to be the same in both wires? Nichrome Aluminum 1.0 mm diameter FIGURE P27.63

-

Assume today is the 21st of February. Using the information below, FT Extract, answer the following questions (parts i and ii). You work for a US company that is due to receive 250 million in June...

-

Basile Corporation (Basile) manufactures and sells pre-made custom doors and related accessories. Basile is a private corporation owned by two non-related individuals. In May 20X6, sold some of their...

-

Abateer company provides interior design services for residential and commercial customers. Assume Abateer entered into the following contracts during the year: 1. A contract with a family renovating...

-

Play Cloth Company, a retailer of childrens clothing, decided to dispose of its European division. The company announced the plan to sell the division on 20 March 20X1. Once the announcement was...

-

crane Inc. common chairs currently sell for $30 each. The firms management believes that it's share should really sell for $54 each. If the firm just paid an annual dividend of two dollars per share...

-

Determine the simple interest earned on $10,000 after 10 years if the APR is 15%

-

give me an example of 10 transactions from daily routine that we buy and put for me Liabilities + Owners' Equity + Revenues - Expenses

Study smarter with the SolutionInn App