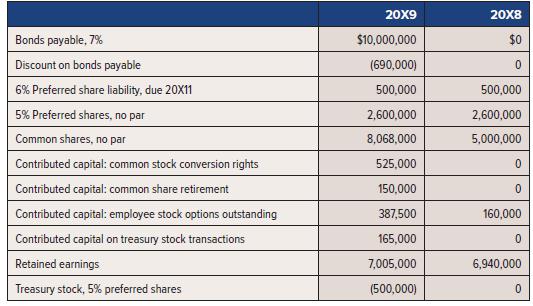

The following data are related to Eli Products Ltd.: During the year, the following transactions took place

Question:

The following data are related to Eli Products Ltd.:

During the year, the following transactions took place and have been correctly recorded:

a. Reported earnings and comprehensive income was $3,200,000. Cash dividends were paid at the end of the year.

b. Retained earnings was reduced by $175,000 as the result of share issue costs.

c. Earnings includes $400,000 of compensation expense recorded for options to employees and also an amount for the 6% preferred share dividends.

d. There was a common share stock dividend during the year that resulted in a reduction to retained earnings of $710,000.

e. Common shares with an average original issuance price of $500,000 were retired during the year.

f. 5% preferred shares with an original average book value of $900,000 were purchased as treasury shares early in the fiscal year. Half were resold almost immediately, and half were kept.

g. Additional common shares were issued for cash, as a stock dividend, and for the options in (i).

h. Convertible bonds were issued during the year. Discount amortization of $41,500 was recorded by the end of the year.

i. Employee stock options, along with $100,000 of cash, were exchanged for common shares during the year.

j. Any remaining change in accounts should be assumed to flow from a logical transaction.

Required:

1. List the items and amounts that caused the retained earnings account to change from its opening to closing balance. For the dividend through retained earnings, specify the amount to each share class.

2. List the items and amounts that caused the common share account to change from its opening to closing balance.

3. List the items that would appear in the financing activities section of the SCF. The company classifies dividends in the operating activities section.

Step by Step Answer: