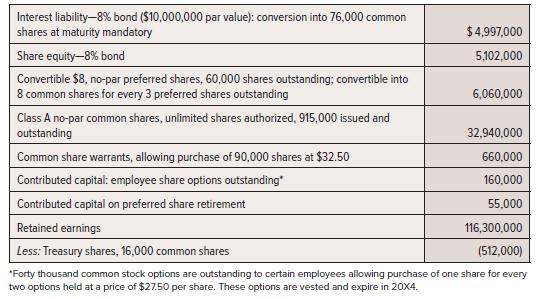

Acer Corp. reported the following balances at 1 January 20X1: The following events took place in 20X1:

Question:

Acer Corp. reported the following balances at 1 January 20X1:

The following events took place in 20X1:

a. Common shares were issued to employees under the terms of existing outstanding share options. 16,000 options were exercised when the share market value was $45.

b. Options were issued in exchange for a piece of land, appraised at $75,000. The options allow purchase of 100,000 shares at $15 each in five years’ time. The market value of the

shares was $46 on this date. The options were valued at $81,000 using the Black-Scholes option pricing model.

c. 40,000 common shares were acquired and retired at a price of $47 each.

d. 10,000 common treasury shares were acquired at a price of $44 per share.

e. A cash dividend was declared and paid. The annual dividend for the preferred shares and $1 per share for the common shares were both declared and paid.

f. 24,000 preferred shares were converted to common shares.

g. The annual interest expense was accrued on the 8% bonds, using the effective rate of 7.8%.

The annual payment was made.

h. Two-thirds of the common share warrants outstanding at the beginning of the year were exercised when the market value of the shares was $49.50; the remainder lapsed.

i. Options were granted to employees at the beginning of the year, allowing purchase of one share for every two options held at a price of $35. Fifty thousand options were issued.

These options become vested at the beginning of 20X5. The fair value of the options was $720,000 and the retention rate for the employee groups covered was estimated at 90%.

j. 10,000 preferred shares were retired for $107 each.

k. 20,000 treasury shares were sold for $32 each.

l. A 10% stock dividend was declared and issued. Treasury shares were not eligible for the stock dividend. The board of directors decided that the stock dividend should be valued at $30 per share. Most of the dividend was issued in whole shares; however, 41,000 fractional shares allowing acquisition of 4,100 whole shares were issued.

Required:

1. Provide journal entries (or memo entries) for the events listed.

2. Calculate the closing balance in each of the listed accounts at 31 December 20X1, reflecting the entries in requirement 1. Earnings for the year were $6,200,000, including interest in (g) and stock option expense in (i).

Step by Step Answer: