The following is the share capital note to the financial statements of Capital Corporation for the year

Question:

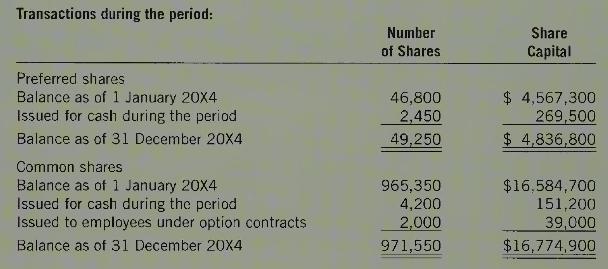

The following is the share capital note to the financial statements of Capital Corporation for the year ended 31 December 20X4:

Note 17 Share capital Authorized share capital consists of an unlimited number of common shares and 100,000 non-voting, cumulative preference shares with a \(\$ 4\) dividend.

The company also reported \(\$ 6,234,900\) in retained earnings.

Required:

1. In what way are the preferred shares likely different than the common shares?

2. What does the term "cumulative" mean?

3. If the company declared a total of \(\$ 350,000\) of dividends on 31 December \(20 \mathrm{X} 4\), how much would the common shareholders receive? No other dividends had yet been declared in 20X4 but dividends had been declared in all prior years.

4. What was the average issuance price for all common shares outstanding at 31 December \(20 \mathrm{X} 4\) ? How does this compare to the price received for shares issued during the period?

5. Give the journal entry that would be recorded if 2,500 common shares were retired for \(\$ 23\) per share on 31 December 20X4.

6. Give the journal entries that would be recorded if 8,200 common treasury shares were purchased for \(\$ 21\) per share and then resold for \(\$ 28\) per share.

Step by Step Answer: