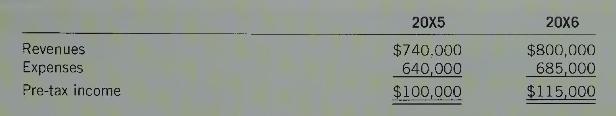

The pre-tax income statements for VCR Corporation for two years (summarized) were as follows: For tax purposes,

Question:

The pre-tax income statements for VCR Corporation for two years (summarized) were as follows:

For tax purposes, the following income tax differences existed:

a. Revenues on the 20X6 statement of profit and loss include \(\$ 45,000\) rent, which is taxable in \(20 \times 5\) but was unearned at the end of \(20 X 5\) for accounting purposes.

b. Expenses on the \(20 \times 6\) statement of profit and loss include membership fees of \(\$ 40,000\), which are not deductible for income tax purposes.

c. Expenses on the \(20 X 5\) statement of profit and loss include \(\$ 32,000\) of estimated warranty costs, which are not deductible for income tax purposes until 20X6.

Required:

1. What was the accounting carrying value and tax basis for unearned revenue and the warranty liability at the end of \(20 \times 5\) and \(20 \times 6\) ?

2. Compute

(a) income tax payable,

(b) deferred income tax and

(c) income tax expense for each period. Assume an average tax rate of \(30 \%\).

3. Give the entry to record income taxes for each period.

4. Complete statements of profit and loss to include income taxes as allocated.

5. What amount of deferred income tax will be reported on the statement of financial position at each year-end?

Step by Step Answer: