Waves Corp., which has a calendar fiscal year, purchased its only depreciable capital asset on 1 January

Question:

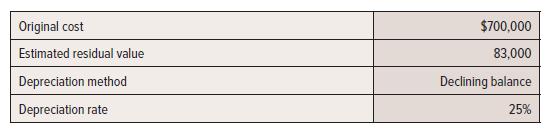

Waves Corp., which has a calendar fiscal year, purchased its only depreciable capital asset on 1 January 20X3. Information related to the asset:

In 20X5, Waves decreased the estimated residual value to $30,000, and increased the depreciation rate to 40%. Both changes are the result of experience with the asset and revised expectations about the pattern of usage.

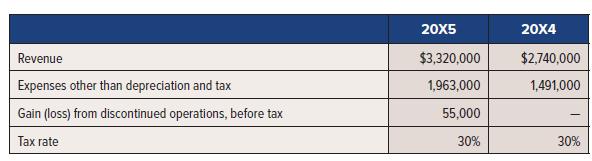

Additional information:

Required:

1. Calculate the ending 20X5 balance of accumulated depreciation, and show the 20X5 entry/entries for depreciation.

2. Provide the condensed comparative statement of comprehensive income for 20X5, including disclosures related to the accounting change.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: