Wen Chu is a senior account manager for a large Canadian bank. The bank is considering the

Question:

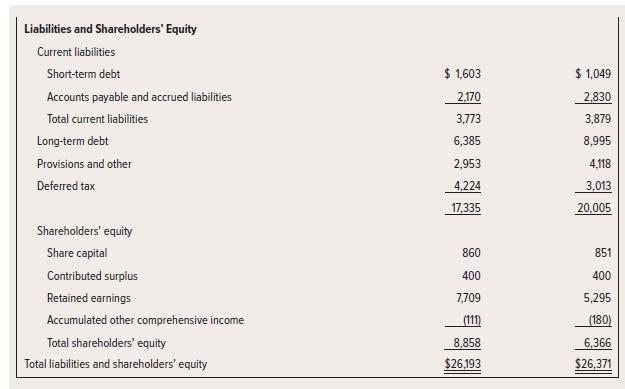

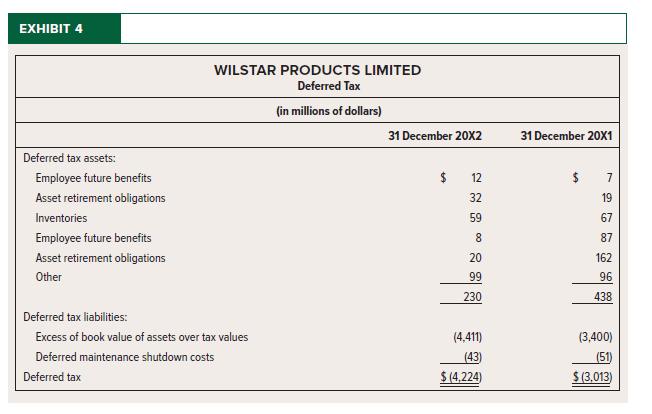

Wen Chu is a senior account manager for a large Canadian bank. The bank is considering the possibility of syndicating a large debenture issue for Wilstar Products Ltd. (WPL), a manufacturer of auto parts. Wen has been given the task of analyzing WPL’s financial performance. When the bank’s account managers or analysts are reviewing any client’s financial statements, the bank’s policy is to remove the effects of income tax allocation in order to enhance the usefulness of the statements for analytical procedures such as evaluating return on investment, earnings, and debt/equity ratios. That is, all deferred tax amounts are eliminated.

Wen has assigned you, analyst, the task of evaluating WPL’s financial statements both with and without the effect of deferred tax (DT). Wen also would like your comments on the likelihood of Wilstar’s accumulated DT being reversed in the foreseeable future.

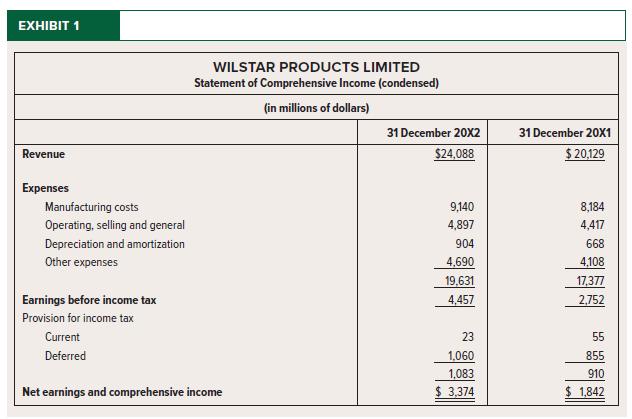

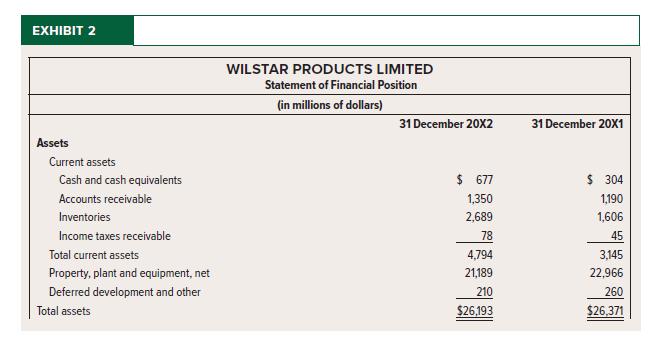

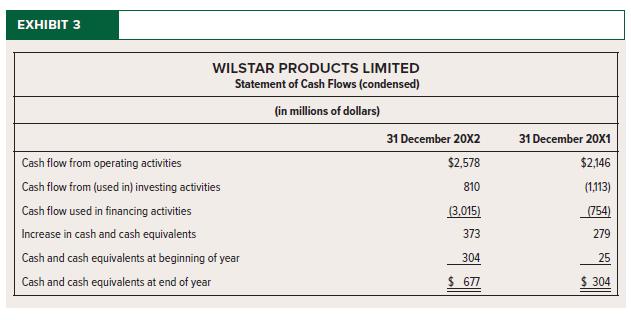

Condensed versions of Wilstar’s SCI, SFP, and SCF are presented in Exhibits 1 to 3. Exhibit 4 shows an excerpt from Note 9 to the financial statements, on Income Taxes.

Required:

Prepare a memo to Wen Chu.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel