The following cases are independent: Case A Information from the 31 December 20X7 SFP of Holdco Ltd.:

Question:

The following cases are independent:

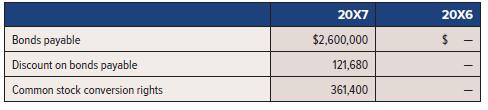

Case A Information from the 31 December 20X7 SFP of Holdco Ltd.:

Convertible bonds were issued during the year. Discount amortization was $7,280 in 20X7.

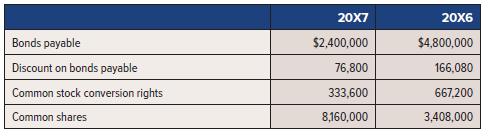

Case B Information from the 31 December 20X7 SFP of Sellco Ltd.:

One-half of the bonds converted to common shares during the period. Other common shares were issued for cash. Discount amortization during the year was $12,480.

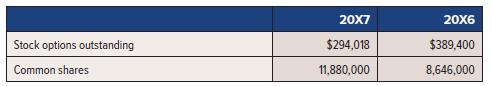

Case C Information from the 31 December 20X7 SFP of Buyco Ltd.:

During the year, 13,200 stock options originally valued at a price of $7.26 were exercised, and 13,200 common shares were issued for the exercise price of $18,48. One million stock options, issued for nil consideration, allowing qualified shareholders to acquire common shares at 1/10 the then-current fair value in the event of hostile takeover, were also issued during the year. Other common shares were sold for cash.

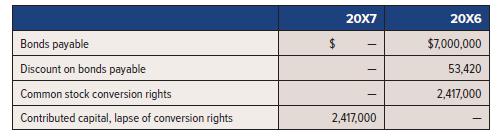

Case D Information from the 31 December 20X7 SFP of Bothco Ltd.:

Bonds payable matured in the year but were redeemed in cash at par and not converted.

Required:

For each case, list the appropriate items on the statement of cash flows caused by issuance, conversion, or derecognition of financial instruments. Do not include disclosure of interest or accounts related to interest expense (e.g., do not list discount amortization).

Step by Step Answer: