Zealand Company made several financial accounting changes in (20 mathrm{X} 6) : First, the company changed the

Question:

Zealand Company made several financial accounting changes in \(20 \mathrm{X} 6\) :

First, the company changed the total useful life from 20 years to 14 years on a \(\$ 350,000\) asset purchased 1 January \(20 \mathrm{X} 2\). The asset was originally expected to be sold for \(\$ 50,000\) at the end of its useful life, but that amount was also changed in \(20 \mathrm{X} 6\), to \(\$ 200,000\). Zealand applies the straight-line method of depreciation to this asset. Depreciation has not yet been recorded in \(20 \mathrm{X} 6\).

Second, the company decided to change inventory costing from FIFO to weighted average (WA) but is unable to accurately determine WA inventory in prior year-ends. The FIFO \(20 X 6\) beginning and ending inventories are \(\$ 30,000\) and \(\$ 45,000\). Under WA, the \(20 X 6\) ending inventory is \(\$ 35,000\). The company expects WA to render income numbers more useful for prediction, given inflation.

Third, the company changed its policy for accounting for certain staff training costs. Previously, the costs were capitalized and amortized straight-line over three years, starting with the year of the expenditure. The new policy is to expense training costs as incurred, in compliance with revised accounting standards for intangible assets. A total of \(\$ 100,000\) was expended in \(20 \mathrm{X} 3, \$ 0\) in \(20 \mathrm{X} 4, \$ 60,000\) in \(20 \mathrm{X} 5\), and \(\$ 45,000\) in \(20 \mathrm{X} 6\).

Fourth, an error in amortizing patents was discovered in 20X6. Patents costing \(\$ 510,000\) on 1 January 20X4 have been amortized over their legal life (20 years). The accountant neglected to obtain an estimate of the patents' economic life, which totalled only five years.

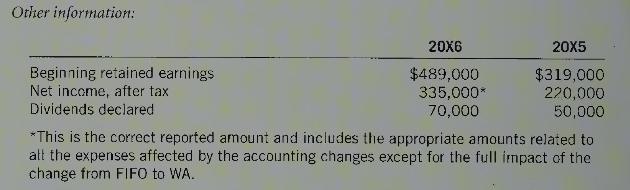

Zealand is a calendar fiscal-year company and is subject to a \(30 \%\) tax rate.

Required:

1. Record the 20X6 entries necessary to make the accounting changes. If the change cannot be made, explain why.

2. Prepare the \(20 \times 5\) and \(20 \times 6\) retained earnings section of the comparative statement of changes in equity, with note disclosures for the accounting changes.

Step by Step Answer: