Armstrong Limited has used the average cost (AC) method to determine inventory values since first formed in

Question:

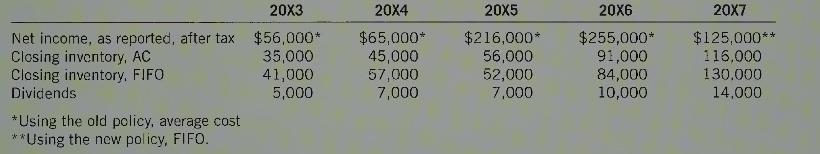

Armstrong Limited has used the average cost (AC) method to determine inventory values since first formed in \(20 X 3\). In \(20 X 7\), the company decided to switch to the FIFO method, to conform to industry practice. Armstrong will still use average cost for tax purposes. The tax rate is \(30 \%\). The following data has been assembled:

Required:

Present the comparative retained earnings statement for \(20 X 7\), giving effect to the change in accounting policy.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: