A lessee has the following amortization schedule for a particular lease: The company entered into the lease

Question:

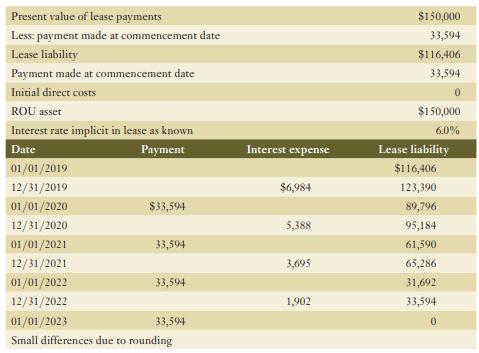

A lessee has the following amortization schedule for a particular lease:

The company entered into the lease at the beginning of its fiscal year, on January 1, 2019. Depreciation follows the straight-line method.

Required:

Provide the appropriate presentation of this lease in the lessee’s statement of financial position for December 31, 2020, distinguishing amounts that are current from those that are non-current.

Present value of lease payments Less: payment made at commencement date Lease liability Payment made at commencement date Initial direct costs ROU asset Interest rate implicit in lease as known Date Payment 01/01/2019 12/31/2019 01/01/2020 12/31/2020 01/01/2021 12/31/2021 01/01/2022 $33,594 33,594 33,594 12/31/2022 01/01/2023 33,594 Small differences due to rounding Interest expense $6,984 5,388 3,695 1,902 $150,000 33,594 $116,406 33,594 0 $150,000 6.0% Lease liability $116,406 123,390 89,796 95,184 61,590 65,286 31,692 33,594 0

Step by Step Answer:

As of December 31 2020 the lessees statement of financial posi...View the full answer

Related Video

In accounting terms, depreciation is defined as the reduction of the recorded cost of a fixed asset in a systematic manner until the value of the asset becomes zero or negligible. An example of fixed assets are buildings, furniture, office equipment, machinery, etc. The land is the only exception that cannot be depreciated as the value of land appreciates with time. Depreciation allows a portion of the cost of a fixed asset to be the revenue generated by the fixed asset. This is mandatory under the matching principle as revenues are recorded with their associated expenses in the accounting period when the asset is in use. This helps in getting a complete picture of the revenue

Students also viewed these Business questions

-

A lessee has the following amortization schedule for a particular lease: The company entered into the lease at the beginning of its fiscal year, on January 1, 2019. Depreciation follows the...

-

The following facts pertain to a non-cancellable lease agreement between Woodhouse Leasing Corporation and McKee Electronics Ltd., a lessee, for a computer system: Inception...

-

The following facts pertain to a non-cancellable lease agreement between Woodhouse Leasing Corporation and McKee Electronics Ltd., a lessee, for a computer system: The collectibility of the lease...

-

If the owner of a company takes merchandise for personal use, what account is debited? a. Owners capital b. Owners withdrawals c. Purchases d. Cash

-

Combine the data from the separate therapies in Exercise 3.7 into a single data set, and construct a relative frequency histogram for this combined data set. Does the plot indicate that the data are...

-

A Newtonian fluid is flowing in a round conduit. The flow is laminar, steady, and fully developed. Determine whether the following statement is true or false: The head loss will vary linearly with...

-

Explain a maturity mismatch for a bank.

-

At the beginning of 2013, Norris Company had a deferred tax liability of $6,400, because of the use of MACRS depreciation for income tax purposes and units-of-production depreciation for financial...

-

A revenue account: is increased by debits. is decreased by credits. has a normal balance of a debit. is increased by credits

-

1. How has David Pinder embraced ethical leadership to create an ethical culture at Cardinal IG? 2. How has Cardinals principles and values shaped the ethical behavior of employees? 3. How has...

-

LaSalle Leasing Company (lessor) agrees on January 1, 2019, to rent Rockwood Winery (lessee) the equipment that Rockwood requires to expand its production capacity to meet customers demands for its...

-

Brow Corp. leased equipment from Rachel Finance, with the following details: Commencement date: January 1, 2019. Term of lease: 4 years. Payments: $45,000 per annum first due at the commencement...

-

Which of the following would most likely be scrutinized under the FTC and DOJ Horizontal Merger Guidelines? a. Two automakers steeped in traditionDaimler-Benz AG and Chrysler Corporationmerge. b....

-

Photon Technologies, Inc., a manufacturer of batteries for mobile phones, signed a contract with a large electronics manufacturer to produce three models of lithium-ion battery packs for a new line...

-

Mastery Problem: Capital Investment Analysis HomeGrown Company HomeGrown Company is a chain of grocery stores that are similar to indoor farmer's markets, providing fresh, local produce, meats, and...

-

McDonald's and CSR There more than 32,000 restaurants around the world (www.aboutmcdonalds.com/etc/medialib/csr/docs. that carry the McDonald's label and logo. As such, they...

-

Smartwatch Based on a survey by Consumer Technology Association, smartwatches are used in 18% of U.S. households. Find the probability that a randomly selected U.S. household has no smartwatches.

-

Suppose you wanted to purchase a commercial real estate property thats valued at $ 1 , 0 0 0 , 0 0 0 . You could secure financing from a traditional bank, which provides you with $ 7 5 0 , 0 0 0 ....

-

(a) Use the figure to construct two scatter diagrams, one for dry pavement and the other for wet pavement. Place the speed of the car on the horizontal axis. (b) Compute the correlation coefficient...

-

Provide an example of an aggressive accounting practice. Why is this practice aggressive?

-

A portion of the combined statement of income and retained earnings of Snap Ltd. for the current year ended December 31, 2020, follows: During the year, Snap Inc. suffered a loss from discontinued...

-

Assume the same information as in BE17.7 except that on October 1, 2020, Laurin declared a 3- for-1 stock split instead of a 10% stock dividend. Calculate the weighted average number of shares...

-

At January 1, 2020, Ming Limited's outstanding shares included the following: 280,000 $50 par value, 7%, cumulative preferred shares 900,000 common shares Net income for 2020 was $2,130,000. No cash...

-

Fibertech GmbH is a distributor of outdoors technical clothing. The company outsources the production of clothing to external manufacturers in Bangladesh and sells the clothing under its own brands....

-

PLEASE HELP WITH PART 2 & 3 Thanks Required information Exercise 1 0 - 7 ( Algo ) Part 2 Prepare journal entries to record the first two interest payments. Journal entry worksheet Record the interest...

-

The following information was available for the year ended December 31, 2022: Net sales $ 300,000 Cost of goods sold 210,000 Average accounts receivable for the year 15,000 Accounts receivable at...

Study smarter with the SolutionInn App