Adler Corp. issued $4,000,000 of 10-year, 4.5% bonds on January 1, 2018, at par. Interest is due

Question:

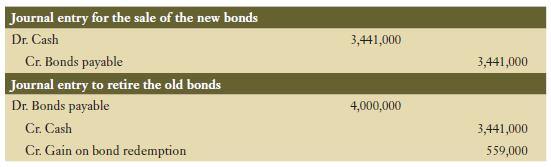

Adler Corp. issued $4,000,000 of 10-year, 4.5% bonds on January 1, 2018, at par. Interest is due annually on December 31. The market rate of interest has since increased dramatically to 8%. As such, Adler can repurchase its bonds on the open market for $3,441,000. They decided to take advantage of this situation, and on January 1, 2023, issued a new series of bonds in the amount of $3,441,000 (five-year bonds, 8% interest payable annually). The bonds were sold at par and the proceeds were used to retire the 4.5% bonds.

Adler has recorded a gain on the retirement, which increases its net income for the year.

Required:

Ignoring transaction costs and taxation effects, is Adler any better off ? Discuss.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: