Case 1: Occidental Petroleum Corporation reported the following information in a recent annual report. Instructions (a) What

Question:

Case 1:

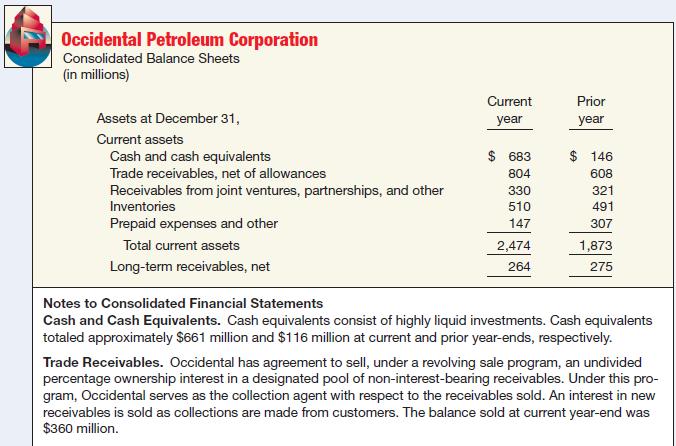

Occidental Petroleum Corporation reported the following information in a recent annual report.

Instructions

(a) What items other than coin and currency may be included in “cash”?

(b) What items may be included in “cash equivalents”?

(c) What are compensating balance arrangements, and how should they be reported in financial statements?

(d) What are the possible differences between cash equivalents and short-term (temporary) investments?

(e) Assuming that the sale agreement meets the criteria for sale accounting, cash proceeds were $345 million, the carrying value of the receivables sold was $360 million, and the fair value of the recourse liability was $15 million, what was the effect on income from the sale of receivables?

(f) Briefly discuss the impact of the transaction in (e) on Occidental’s liquidity.

Case 2:

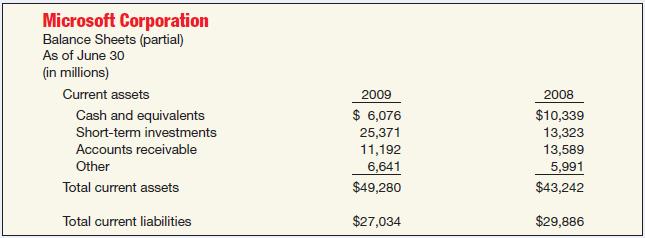

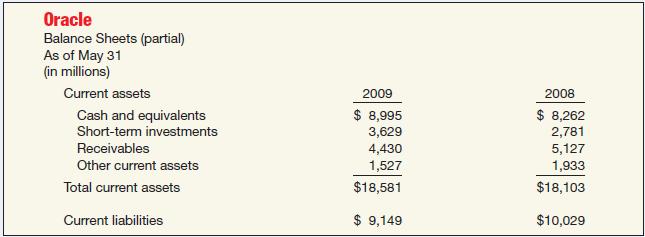

Microsoft is the leading developer of software in the world. To continue to be successful Microsoft must generate new products, which requires significant amounts of cash. Shown below is the current asset and current liability information from Microsoft’s June 30, 2009, balance sheet (in millions). Following the Microsoft data is the current asset and current liability information for Oracle (in millions), another major software developer.

Part 1:

Instructions

(a) What is the definition of a cash equivalent? Give some examples of cash equivalents. How do cash equivalents differ from other types of short-term investments?

(b) Calculate (1) the current ratio and (2) working capital for each company for 2009 and discuss your results.

(c) Is it possible to have too many liquid assets?

Part 2:

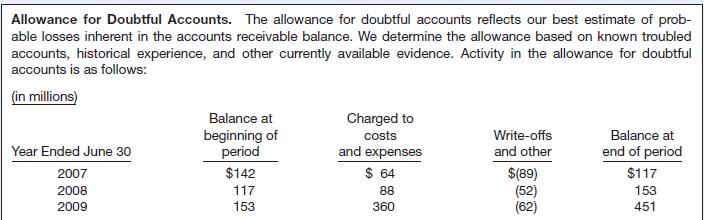

Microsoft provided the following disclosure related to its accounts receivable.

Instructions

(a) Compute Microsoft’s accounts receivable turnover ratio for 2009 and discuss your results. Microsoft had sales revenue of $58,437 million in 2009.

(b) Reconstruct the summary journal entries for 2009 based on the information in the disclosure.

(c) Briefly discuss how the accounting for bad debts affects the analysis in Part 2 (a).

Step by Step Answer: