Computer Consulting Limited was started in early 2016 and continued to operate until early 2012, when it

Question:

Accounting policy set 1:

a. Use straight-line depreciation method on the firm€™s only asset. The computer cost $1,000,000 and has an estimated useful life of four years.

b. Estimate warranty expense as 9% of sales.

c. Estimate bad debts expense as 5% of sales.

Accounting policy set 2:

a. Use 50% declining-balance method for depreciation.

b. Estimate warranty expense as 10% of sales.

c. The year-end allowance for doubtful accounts should be 40% of gross accounts receivable.

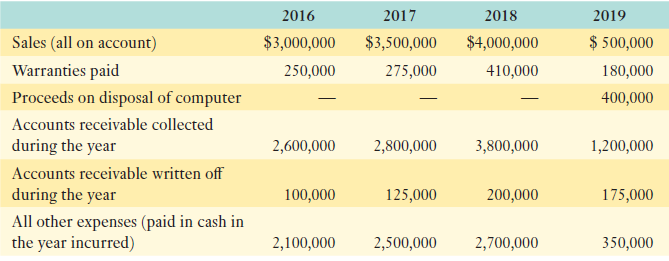

Actual events, cash flows, and transactions are as follows:

Required:

a. Derive net income for 2016 to 2019 using the first set of accounting policies. For the year end balance for 2019, assume accounts receivable, allowance for doubtful accounts, and the warranty accrual are $0, as the firm wound itself up during the year and all timing differences have been resolved.

b. Derive net income for 2016 to 2019 using the second set of accounting policies. For the year-end balance for 2019, assume accounts receivable, allowance for doubtful accounts, and the warranty accrual are $0, as the firm wound itself up during the year and all timing differences have been resolved.

c. Derive the annual net cash flows for 2016 to 2019.

d. What is the sum of the net income for the four years for the two sets of accounting policies? What is the sum of the net cash flows for the four years? What does this tell us about net income and accrual accounting?

e. Why were the net incomes different between the two sets of accounting policies?

f. What caused the net income in 2019 to be so high for the second set of accounting policies?

Step by Step Answer: