CPF Corporation operates in a jurisdiction that does not limit carryforwards and allows losses to be carried

Question:

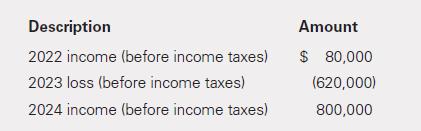

CPF Corporation operates in a jurisdiction that does not limit carryforwards and allows losses to be carried back for two years. CPF Corporation reported the following results for its first 3 years of operation:

There were no permanent or temporary differences during these 3 years. Assume a corporate tax rate of 46% for 2022, 40% for 2023, and 34% for 2024. CPF elects to use the carryback/carryforward provision. All tax rates were enacted at the beginning of the year. No tax rate changes are known until the year of change.

Required

a. What income (loss) should CPF report in 2023? (Assume that any deferred tax asset recognized is more likely than not to be realized.)

b. Prepare the journal entry(ies) to record the tax provision for 2023.

c. Prepare the journal entry or entries to record the tax provision for 2024.

d. Independent of your answer to part (a), assume now that CPF elects to use the carryforward-only provision, not the carryback provision. What income (loss) does CPF report in 2023?

e. Using the assumptions made in part (d), prepare the journal entry entries for 2023.

f. Using the assumptions made in part (d), prepare the journal entry entries for 2024.

Step by Step Answer:

Intermediate Accounting

ISBN: 9780136946694

3rd Edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella