Dev Equipment Corp. usually closes its books on December 31, but at the end of 2020 it

Question:

Dev Equipment Corp. usually closes its books on December 31, but at the end of 2020 it held its cash book open so that a more favourable statement of financial position could be prepared for credit purposes. Cash receipts and disbursements for the first 10 days of January were recorded as December transactions. The company uses a periodic inventory system. The following information is given:

1. January cash receipts recorded in the December cash book totalled $38,900. Of that amount, $25,300 was for cash sales and $13,600 was for collections on 2020 accounts receivable.

2. January cash disbursements that were recorded in the December cheque register were for payments relating to $24,850 of accounts payable.

3. The general ledger has not been closed for 2020.

4. The amount shown as inventory was determined by a physical count on December 31, 2020.?

Instructions

a. Prepare any entries that you consider necessary to correct Dev Equipment Corp.?s accounts at December 31.

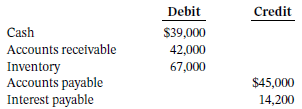

b. To what extent was Dev Equipment Corp. able to show a more favourable SFP at December 31 by holding its cash book open? (Hint: calculate working capital and relevant liquidity ratios.) Assume that the SFP that the company prepared showed the following amounts before any required adjustments:

c. Ethics Discuss the ethical implications of holding the cash book open and showing a more favourable SFP.

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 978-1119496496

12th Canadian edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy