Eight independent situations are described below. Each involves future deductible amounts and/or future taxable amounts ($ in

Question:

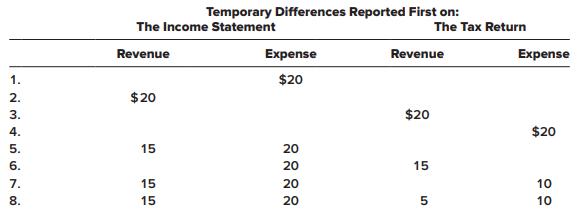

Eight independent situations are described below. Each involves future deductible amounts and/or future taxable amounts ($ in millions).

Required:

For each situation, determine taxable income, assuming pretax accounting income is $100 million.

Transcribed Image Text:

Temporary Differences Reported First on: The Income Statement The Tax Return Revenue Expense Revenue Expense 1. $20 2. $20 3. $20 4. $20 5. 15 20 6. 20 15 7. 15 20 10 8. 15 20 10

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (9 reviews)

Temporary difference Temporary d...View the full answer

Answered By

Felix Onchweri

I have enough knowledge to handle different assignments and projects in the computing world. Besides, I can handle essays in different fields such as business and history. I can also handle both short and long research issues as per the requirements of the client. I believe in early delivery of orders so that the client has enough time to go through the work before submitting it. Am indeed the best option that any client that can think about.

4.50+

5+ Reviews

19+ Question Solved

Related Book For

Intermediate Accounting

ISBN: 9781259722660

9th Edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas

Question Posted:

Students also viewed these Business questions

-

Four independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences: The enacted tax rate is 25%. Required: For...

-

Two independent situations are described below. Each involves future deductible amounts and/ or future tax-able amounts produced by temporary differences: The enacted tax rate is 40% for both...

-

Four independent situations are described below. For each, annual lease payments of $100,000 (not including any executory costs paid by lessor) are payable at the beginning of each year. Each is a...

-

Calculate the numerical value of cross-price elasticity, exy, in each of the following situations. Do not round your interim calculations before obtaining the final solution (i.e. do not clear your...

-

Early Bird Bakeries Ltd. (EBB) is planning to pay a special dividend per share, over and above its regular quarterly dividend, at the end of the fourth quarter of 2012. EBB ended 2009 with retained...

-

NCF & Partners (NCF) is a firm of CPAslocated in Whitby that has been in business for 20 years. NCF's revenue has declined steadily over the past few years. The partners are looking for ways...

-

Attitudes toward recycled products Refer to Exercise 41. (a) State appropriate hypotheses for performing a chisquare test of independence in this setting. (b) Compute the expected counts assuming...

-

The production department described in Exercise 20-8 had $850,368 of direct materials and $649,296 of conversion costs charged to it during April. Also, its beginning inventory of $167,066 consists...

-

if X,Y,Z are three partners on 1/1/2020 their capital balances are (10,000 15,000 20,000) respectively on the same date X agree to purchase 50% of Z capital what are the credit side of the journal ?...

-

Describe the three phases of the evolution of forecasting/prediction.

-

Listed below are 10 causes of temporary differences. For each temporary difference indicate the balance sheet account for which the situation creates a temporary difference. Temporary Difference 1....

-

When a company records a deferred tax asset, it may need to also report a valuation allowance if it is more likely than not that some portion or all of the deferred tax asset will not be realized....

-

1. Describe the fraud that allegedly occurred through Sino-Forest Corporation Inc.? Who benefited and how? 2. Why didnt regulators prevent this fraud from occurring? What were they relying on? 3. Why...

-

How do emergent states such as cohesion, potency, and mental models influence team effectiveness and performance in complex and dynamic environments ?

-

2. How do you feel about the progress IKEA Group has made in implementing this plan? I'm looking for analysis for 2-3 pages with a minimum of 3-4 references for this case. Case study: Sustainability...

-

Companies that engage international business do so in pursuit of a broad range of goals. Nonetheless, the text identifies key drivers, noting that the typical company expands operations...

-

How do lifestyle changes, such as urbanization or an aging population, affect consumer needs and preferences in our industry?

-

Verify that the following general thermodynamic property relationships are valid for the specific case of an ideal gas: (a) T = au (b) P = -9) av

-

Write a function to reverse part of the passed sound just between the passed start and end index.

-

Assessing simultaneous changes in CVP relationships Braun Corporation sells hammocks; variable costs are $75 each, and the hammocks are sold for $125 each. Braun incurs $240,000 of fixed operating...

-

Unit, Group, and Composite Depreciation The certified public accountant is frequently called upon by management for advice regarding methods of computing depreciation. Of comparable importance,...

-

Unit, Group, and Composite Depreciation The certified public accountant is frequently called upon by management for advice regarding methods of computing depreciation. Of comparable importance,...

-

DepreciationStrike, Units-of-Production, Obsolescence Presented below and are three different and unrelated situations involving depreciation accounting. Answer the question(s) at the end of each...

-

Eye Deal Optometry leased vision - testing equipment from Insight Machines on January 1 , 2 0 2 4 . Insight Machines manufactured the equipment at a cost of $ 2 0 0 , 0 0 0 and lists a cash selling...

-

Business law A person may have the liability of a partner even though no partnership exists True False

-

help! ee all photos + Add to o e D C N X Edit & Create Share Table of Contents No sales to an individual customer accounted for more than 10% of revenue during any of the last three fiscal years. Net...

Study smarter with the SolutionInn App