Four independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by

Question:

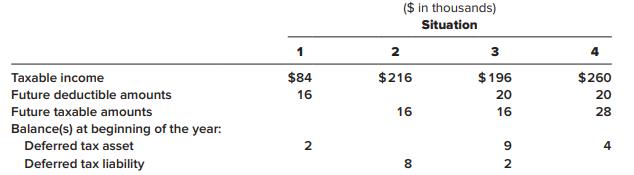

Four independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences:

The enacted tax rate is 25%.

Required:

For each situation, determine the:

a. Income tax payable currently.

b. Deferred tax asset—balance.

c. Deferred tax asset—change.

d. Deferred tax liability—balance.

e. Deferred tax liability—change.

f. Income tax expense.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas

Question Posted: