Elton Co. has the following post-retirement benefit plan balances on January 1, 2020. Accumulated post-retirement benefit obligation................$2,250,000Fair

Question:

Elton Co. has the following post-retirement benefit plan balances on January 1, 2020.

Accumulated post-retirement benefit obligation................$2,250,000Fair value of plan assets............................................................2,250,000

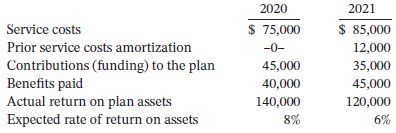

The interest (settlement) rate applicable to the plan is 10%. On January 1, 2021, the company amends the plan so that prior service costs of $175,000 are created. Other data related to the plan are:

Instructions

a. Prepare a worksheet for the post-retirement plan in 2020.

b. Prepare any journal entries related to the post-retirement plan that would be needed at December 31, 2020.

c. Prepare a worksheet for 2021 and any journal entries related to the post-retirement plan as of December 31, 2021.

d. Indicate the post-retirement-benefit?related amounts reported in the 2021 financial statements.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1119503668

17th edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfiel