Using the information in E20.13 about Erickson Company?s defined benefit pension plan, prepare a 2020 pension worksheet

Question:

Using the information in E20.13 about Erickson Company?s defined benefit pension plan, prepare a 2020 pension worksheet with supplementary schedules of computations. Prepare the journal entries at December 31, 2020, to record pension expense and related pension transactions. Also, indicate the pension amounts reported in the balance sheet.

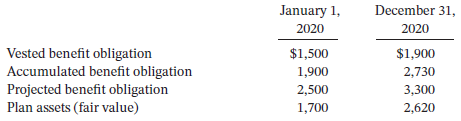

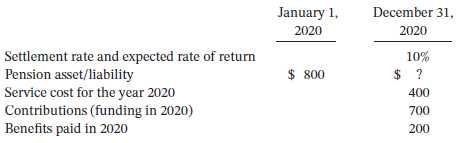

December 31, 2020 $1,900 2,730 3,300 2,620 January 1, 2020 Vested benefit obligation Accumulated benefit obligation Projected benefit obligation Plan assets (fair value) $1,500 1,900 2,500 1,700 January 1, 2020 December 31, 2020 Settlement rate and expected rate of return Pension asset/liability Service cost for the year 2020 Contributions (funding in 2020) Benefits paid in 2020 10% $ ? 400 $ 800 700 200

Step by Step Answer:

Journal entries 123120 1 Other Comprehensive Income GL 100 Pension Expense 480 Pension Asset Liabili...View the full answer

Intermediate Accounting

ISBN: 978-1119503668

17th edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfiel

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Business questions

-

Using the information in E20-13B about Shiloh Acres' defined-benefit pension plan, prepare a 2014 pension worksheet with supplementary schedules of computations. In E20-13B, Shiloh Acres sponsors a...

-

Using the information in E20-2 prepare a pension worksheet inserting January 1, 2010, balances, showing December 31, 2010, balances, the reconciliation schedule, and the journal entry recording...

-

Using the information in E20-13 about Linda Berstler Companys defined benefit pension plan, prepare a 2010 pension worksheet with supplementary schedules of computations. Prepare the journal entries...

-

Jones Archaeology began 2018 with retained earnings of $180,000. During 2018, Jones made sales of $832,000 with 56% of sales allocated to cost of goods sold. Selling and administrative expense for...

-

The Chemistry in Action essay on p. 210 describes the cooling of rubidium vapor to 1.7 10-7 K. Calculate the root-mean-square speed and average kinetic energy of a Rb atom at this temperature.

-

given the diversity of individual personalities in a team, what measures could you take to maintain or increase your teams social capital? For example, how would you get more introverted colleagues...

-

Would you describe Starbucks production/ operations technology in its retail stores as unit, mass, or process? How about in its roasting plants? (Hint: you might need to review material in Chapter...

-

Assume that today is March 7, and, as the newest hire for Goldman Sachs, you must advise a client on the costs and benefits of hedging a transaction with options. Your client (a small U.S. exporting...

-

1. Consider the following data. I/S | 2015 1,200 2016 1,320 (+10% Sales (S) 1,000 200 20 - Costs (C) (COGS & SG&A) = EBITDA EEBIT) - Interest =EBT - Tax (T) = NI Dividend Plowback 180 40 140 40 100...

-

Consider the project data model shown in Figure 1-15. a. Create a textual description of the diagrammatic representation shown in the figure. Ensure that the description captures the...

-

Latoya Company provides the following selected information related to its defined benefit pension plan for 2020. Pension asset/liability (January 1)..............................................$...

-

Elton Co. has the following post-retirement benefit plan balances on January 1, 2020. Accumulated post-retirement benefit obligation................$2,250,000Fair value of plan...

-

In January 2010, Coaticook Inc. (Coaticook) purchased a patent for a pharmaceutical designed to help bald people to grow hair. The drug behind the patent was considered revolutionary at the time and...

-

Financial Reporting Problem Marks and Spencer plc (M&S) The financial statements of M&S (GBR) are presented in Appendix A. The companys complete annual report, including the notes to the...

-

Totally Chemical is considering an investment decision project in which the organization expands into the trucking business. Totally Chemical wants to begin this investment decision project by buying...

-

Presented below is the balance sheet of Sandhill Corporation as of December 31, 2017. SANDHILL CORPORATION BALANCE SHEET DECEMBER 31, 2017 Goodwill (Note 2) Buildings (Note 1) Inventory Land Accounts...

-

Find the best predicted tip for a ride that is 3.10 miles. How does the result compare to the actual tip of $4.55? Find the best predicted fare amount for a distance of 3.10 miles. How does the...

-

Since the SUTA rates changes are made at the end of each year, the available 2022 rates were used for FUTA and SUTA. Note: For this textbook edition the rate 0.6% was used for the net FUTA tax rate...

-

Identify a specific features for a DSS (or your choice) that would be driven by the decision-making style issues discussed by Dreyfus and Dreyfus. Identify the feature, how you would operationalize...

-

Does log 81 (2401) = log 3 (7)? Verify the claim algebraically.

-

On January 1, 2014, Fresh Juice Ltd. entered into a purchase commitment contract to buy 10,000 oranges from a local company at a price of $0.50 per orange anytime during the next year. The contract...

-

Merry Ltd., paid $250 for the option to buy 1,000 of its common shares for $15 each. The contract stipulates that it may only be settled by exercising the option and buying the shares. Merry Ltd....

-

The following situations occur independently. 1. A company knows that it will require a large quantity of euros to pay for some imports in three months. The current exchange rate is satisfactory, and...

-

You are considering the purchase of new living room furniture that costs $1,180. The store will allow you to make weekly payments of $25.89 for one year to pay off the loan. What is the EAR of this...

-

Question 17 (2 points) An increase in assets: Increases income Does not affect cash Increases cash Reduces cash

-

Martell Mining Companys ore reserves are being depleted, so its sales are falling. Also, because its pit is getting deeper each year, its costs are rising. As a result, the companys earnings and...

Study smarter with the SolutionInn App