Harris, Harmar and Higgins are partners in the consulting firm of Harris and Associates. The balance sheet

Question:

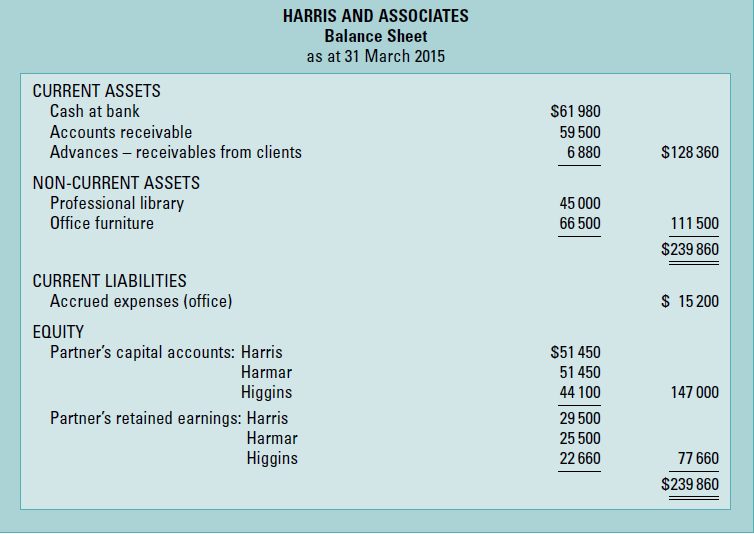

Harris, Harmar and Higgins are partners in the consulting firm of Harris and Associates. The balance sheet of the partnership as at 31 March 2015 is shown below.

It was agreed that all profits would be divided equally between the partners.

Business transactions for the year ending 31 March 2016 were as follows (ignore GST):

Invoices issued for services to clients | $ | 450 000 | ||

Cash receipts: Accounts for fees collected Advances made on behalf of clients repaid | 452 000 45 000 | |||

$ | 497 000 | |||

Cash payments: Salaries Rent Office expenses Library maintenance Advances made on behalf of clients Insurance premiums Drawings: Harris Harmar Higgins | $ | 92 800 18 000 19 500 9 200 40 000 6 500 96 000 72 900 36 300 |

$ | 391 200 | |

Accounts payable for office expenses at 31/3/16, $15 000. Furniture to be depreciated at 15% p.a. |

Required

A. Prepare the income statement for the year ended 31 March 2016.

B. Prepare a statement of changes in partners’ equity for the year ended 31 March 2016.

C. Prepare the balance sheet as at 31 March 2016.

PartnershipA legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer:

Accounting

ISBN: 978-1118608227

9th edition

Authors: Lew Edwards, John Medlin, Keryn Chalmers, Andreas Hellmann, Claire Beattie, Jodie Maxfield, John Hoggett