Income taxes came into being in Canada in 1917 as a temporary measure to finance the costly

Question:

Income taxes came into being in Canada in 1917 as a “temporary” measure to finance the costly World War I. Ever since then, as surely as night follows day, complaints about income taxation have been frequent but expected. These complaints come from all directions, varying from cries that tax rates are too high, or that governments waste tax revenues, to allegations that certain taxpayers do not pay their fair share of taxes.

The global recession in 2008–2009 threw the budgets of most governments in the world out of balance. Canadian governments were not spared. For example, the federal government’s budget swung from a modest surplus of $3 billion in the fiscal year ended March 31, 2008, to a deficit of $54 billion for the year ended March 31, 2010. Under these circumstances, the government sought any means possible to reverse the dramatic deficits.

Your good friend Clark Stevens, a (fictitious) member of parliament, has heeded the call for ideas and is examining ways for the government to obtain higher revenues. Stevens is, of course, aware that raising the tax rate will help to increase revenues, but higher tax rates will also dampen economic activity, which has already suffered due to the recession. Thus, Stevens is looking for more creative alternatives.

Knowing that you are an expert in financial reporting, Stevens meets with you to discuss his ideas:

STEVENS: I have two ideas to raise more tax revenue, but I don’t know if they’ll work.

YOU: I’ll see if I can help.

STEVENS: Well, for my first idea, I want to close down some of the bigger tax loopholes that are unfairly rewarding some taxpayers, especially large corporations. For example, I was looking at the financial statements of Toronto Dominion Bank (TD), one of Canada’s largest financial institutions. The bank seems to pay an amazingly small amount of tax and that’s not right!

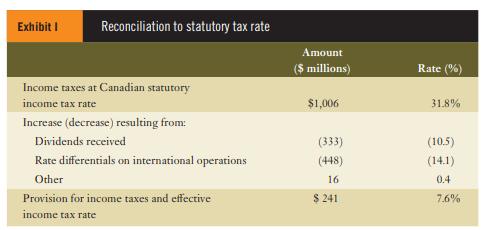

He hands you the financial statements for the year ended October 31, 2009, with the following excerpt in Note 28 highlighted:

STEVENS: Look at that—7.6%. Who do you know pays only 7.6% in taxes?

YOU: Hmm. Interesting.

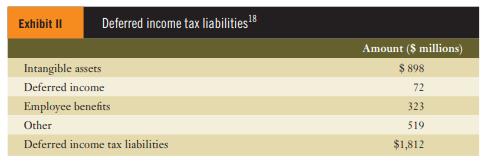

STEVENS: Not only that, but take a look at this.

(He points to the following excerpt.)

STEVENS: Looks like TD has paid only $241 million and owes the government another $1.8 billion that it hasn’t paid. I don’t know how these guys are getting away with it, but I want to put a stop to it. And I don’t think it’s just TD—there are probably dozens or even hundreds of other companies in similar situations. If we could get even half of what’s owed to us, we could cut the deficit down to size in a hurry.

YOU: Well, it’s not quite that straightforward.

STEVENS: Why don’t you think about it carefully and then write me a short report so I fully understand the issues? Then I’ll know how to approach Cabinet about this.

YOU: All right, I’ll do my best.

Required:

Draft the report requested by Clark Stevens.

Step by Step Answer: