Janes Steel Inc. sells bonds to the investing public to finance the acquisition of a new foundry.

Question:

Jane’s Steel Inc. sells bonds to the investing public to finance the acquisition of a new foundry. On July 1, 2018, the company sells $8,000,000 of 3% bonds priced to yield 3.5% for $7,887,020. The bonds mature on July 1, 2021, with interest payable on June 30 and December 31 each year. The corporate year-end is December 31.

Required:

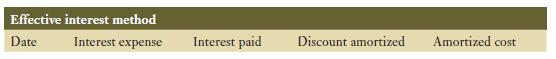

a. Complete a bond amortization spreadsheet using the format that follows:

b. Prepare the journal entry to record the issuance of the bonds.

c. Prepare the journal entry to record the payment of interest and related amortization on December 31, 2019.

d. Prepare the journal entry to record the derecognition of the bonds at maturity.

e. Briefly explain the difference between the primary market for bonds and the over-the-counter (OTC) market.

Step by Step Answer: