Magic Cleaning Services (MCS) has a fiscal year-end of December 31. It is the first year of

Question:

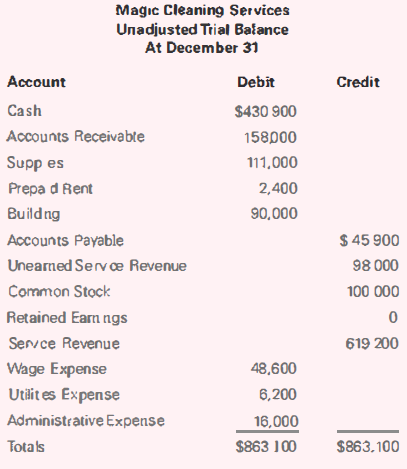

Magic Cleaning Services (MCS) has a fiscal year-end of December 31. It is the first year of operations. At of year-end, MCS has the following unadjusted trial balance:

Addition, it has not adjusted for the following transactions:

- All of the prepaid rent expired by the end of the year.

- The building was purchased early this year and has a 30-year life with no residual value. Depreciation is to be recorded for a full year on a straight-line basis.

- The company provided a portion of the services related to an advance collection on December 20. It performed one-half of the services to be performed in the current year.

- Wages for the current year in the amount of $24,000 should be accrued and are set to be paid out to workers in January.

Required:

a. Journalize necessary adjusting journal entries. Omit explanations.

b. Prepare an adjusted trial balance as of December 31, 2018.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting

ISBN: 978-0134730370

2nd edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella

Question Posted: