Oculus is a proprietorship that produces a specialized type of round windows. It is after the fiscal

Question:

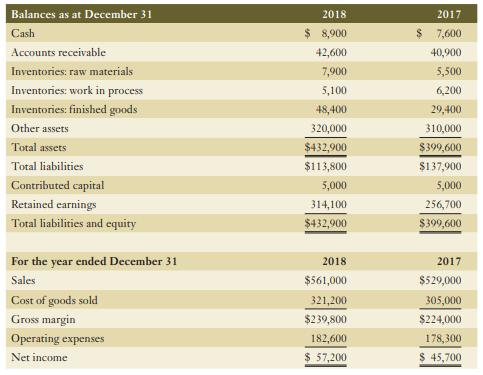

Oculus is a proprietorship that produces a specialized type of round windows. It is after the fiscal year-end for 2018, and the owner has drafted the financial statements for the business for presentation to the bank and for tax purposes. The following provides a summary of those financial statements, along with comparative information for the prior year:

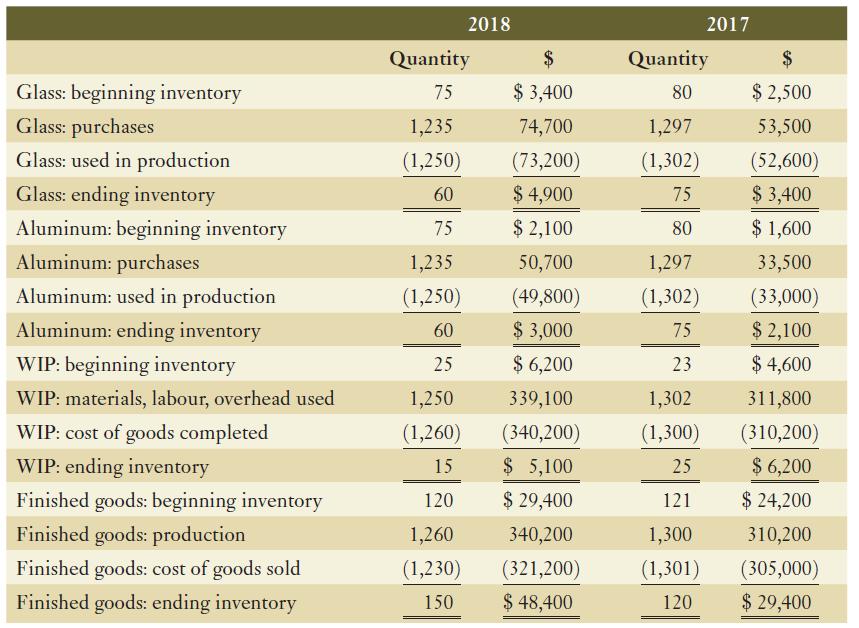

Raw materials consist of glass and aluminum. Due to their nature, these inventories cannot be specifically identified. Consequently, Oculus has used the first-in, first-out (FIFO) method for all of its inventories. Oculus uses a periodic inventory system, and the above financial information has been prepared using FIFO.

Raw materials consist of glass and aluminum. Due to their nature, these inventories cannot be specifically identified. Consequently, Oculus has used the first-in, first-out (FIFO) method for all of its inventories. Oculus uses a periodic inventory system, and the above financial information has been prepared using FIFO.

Input prices had been reasonably stable prior to 2017. However, as a result of rapidly rising prices for raw material inputs, the owner of Oculus feels that the FIFO method is overstating income. He wonders whether and by how much his financial results would change if he were to use the weighted-average cost method for inventories. To help address this issue, he has assembled additional information on the inventories for Oculus (raw material quantities are expressed in units equivalent to one standard finished window):

Step by Step Answer: