The Australian government has contracted with alternative energy industry organisations to develop new energy technologies. These contracts

Question:

The Australian government has contracted with alternative energy industry organisations to develop new energy technologies. These contracts are sometimes based on cost. Because these organisations are also developing technologies for non-government entities, incentives exist to shift overhead costs to the government so that commercial operations become more competitive.

Because cost allocations are private information, research provides only indirect evidence that this cost shifting occurs. The following vignette is fictional, but it illustrates potential ethical problems that arise when governments use cost-based contracts for product development.

Deep Water Hydro is a hydroelectricity energy company that focuses on innovative research and development solutions for alternative energy supply for both commercial and government agencies. Because one of its commercial contracts fell through last year, the entity had fewer jobs than anticipated. Consequently, the company’s overhead costs were underapplied at the end of the year, so an adjustment was made to increase cost of sales.

Deep Water’s policy is to allocate production overhead as a percentage of direct labour costs for each contract. One of the government contracts completed last year was to develop a hydroelectricity generator that would supply energy from seawater entering Port Philip Bay in Melbourne. The job contract was based on cost-plus-fixed-fee for a total cost of $245 million.

The hydroelectricity project was Deep Water’s only government contract last year. Commercial business completed was $105 million, so cost of sales totalled $350 million.

Disagreement about underapplied overhead adjustment

The government official in charge of the contract complained to the federal contract auditor that Deep Water’s underapplied overhead should not have been closed to cost of sales. Instead, he argued that it should have been allocated on a pro rata basis among the contracts in progress, finished goods and cost of sales. The auditor asked to see the cost accounting records and financial statements for the period.

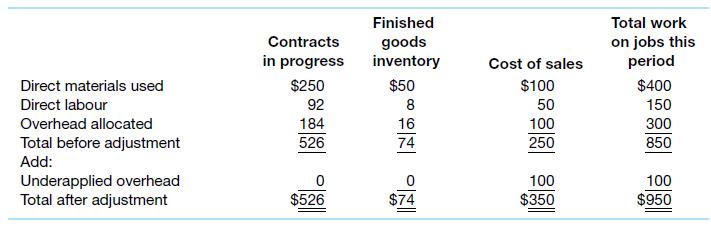

The $350 million in cost of sales included $245 million for the government contract. When the underapplied overhead ($100 million) was closed to cost of sales, the government portion of underapplied overhead was $70 million [$100 × ($245 ÷ $350)]. Because the contract specified that the government would pay costs plus a fixed amount, the overhead adjustment effectively increased the revenue under the contract by $70 million. Following is an analysis of the direct costs and cost allocations (in millions).

Actual direct labour costs were $150 million, and the pre-adjustment allocated overhead was $300 million. Therefore, the original allocation rate was 200 per cent ($300 ÷ $150) of direct labour cost. Total actual overhead turned out to be $400 million (the $300 million plus the $100 million underapplied). If Deep Water accountants could have perfectly estimated overhead at $400 million and direct labour cost at $150 million, they would have used 267 per cent ($400 ÷ $150) as the allocation rate.

The underapplied overhead amount was material ($100 million out of $400 million, or 25 per cent). Therefore, the government auditor decided that it should have been allocated on a pro rata basis among the three accounts that reflected work done this period: contracts in progress, finished goods and cost of sales. Had this method been used, the adjustment would have been allocated as follows:

.......................................................................................................................................(millions)

Contracts in progress ($526 million ÷ $850 million) × $100 million ...................... $ 61.9

Finished goods ($74 million ÷ $850 million) × $100 million ........................................ 8.7

Cost of sales ($250 million ÷ $850 million) × $100 million ......................................... 29.4

Total adjustment ........................................................................................................ $100.0

The government’s share of the cost of sales adjustment would be ($245 ÷ $350) × $29.4 million equals $20.6 million. When the auditor compared this to the original adjustment of $70 million, she knew the government had been overcharged.

Alternative methods for allocating overapplied or underapplied overhead

The auditor offered Deep Water three alternatives for allocating the overhead adjustment. Under governmental contracts, underapplied overhead could be allocated based on direct materials cost, direct labour cost or total direct costs. If Deep Water uses direct materials, cost of sales is increased by $25 million, of which the government portion is $17.5 million. If direct labour cost is used, cost of sales is increased by $33.3 million, of which the government portion is $23.3 million. If total direct cost is used, cost of sales is increased by $27.3 million, of which the government portion is $20.1 million.

The government and Deep Water must now negotiate to determine the most appropriate proration method.

Required

(a) Is allocating proportionately more cost to government contracts an ethical problem for Deep Water? Why?

(b) When the government pays more than commercial customers pay for work done, does this situation pose a business problem, a social problem or both? Explain.

(c) Discuss the preferences of various stakeholders for this problem, including:

• Managers

• Shareholders

• Commercial customers

• Governmental customers

• Competitors

• Australian taxpayers.

(d) Is it fair for the government to pay more for products and services than commercial customers pay? Is it fair for taxes to subsidise the overhead costs for a private business?

(e) How can an entity monitor whether its accounting practices are ethical?

Step by Step Answer:

Management Accounting

ISBN: 9780730369387

4th Edition

Authors: Leslie G. Eldenburg, Albie Brooks, Judy Oliver, Gillian Vesty, Rodney Dormer, Vijaya Murthy, Nick Pawsey