On December 1, 2021, Aaron Brandon Ltd. entered into a binding agreement to buy inventory costing US$200,000

Question:

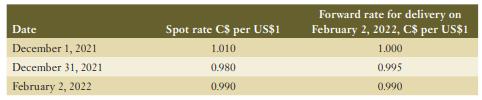

On December 1, 2021, Aaron Brandon Ltd. entered into a binding agreement to buy inventory costing US$200,000 for delivery on February 16, 2022. Terms of the sale were COD (cash on delivery). Aaron, which has a December 31 year-end, decided to hedge its foreign exchange risk and entered into a forward agreement to receive US$200,000 at that time. Aaron designated the forward a fair value hedge. Pertinent exchange rates follow:

Required:

Record the required journal entries for December 1, December 31, and February 2 using the net method. If no entries are required, state “no entry required” and indicate why.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: