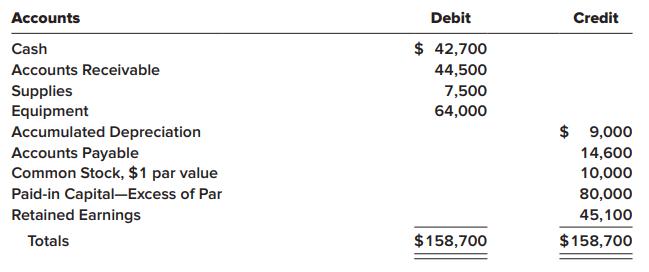

On January 1, 2021, the general ledger of Freedom Fireworks includes the following account balances: During January

Question:

On January 1, 2021, the general ledger of Freedom Fireworks includes the following account balances:

During January 2021, the following transactions occur:

January 2 Issue an additional 2,000 shares of $1 par value common stock for $40,000.

January 9 Provide services to customers on account, $14,300.

January 10 Purchase additional supplies on account, $4,900.

January 12 Repurchase 1,000 shares of treasury stock for $18 per share.

January 15 Pay cash on accounts payable, $16,500.

January 21 Provide services to customers for cash, $49,100.

January 22 Receive cash on accounts receivable, $16,600.

January 29 Declare a cash dividend of $0.30 per share to all shares outstanding on January 29. The dividend is payable on February 15. (Freedom Fireworks had 10,000 shares outstanding on January 1, 2021, and dividends are not paid on treasury stock.)

January 30 Reissue 600 shares of treasury stock for $20 per share.

January 31 Pay cash for salaries during January, $42,000.

The following information is available on January 31, 2021.

1. Unpaid utilities for the month of January are $6,200.

2. Supplies at the end of January total $5,100.

3. Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equipment was purchased, the company estimated a service life of three years and a residual value of $10,000.

4. Accrued income taxes at the end of January are $2,000.

Required:

1. Record each of the transactions listed above in the “General Journal” tab (these are shown as items 1–10) assuming a FIFO perpetual inventory system. Review the “General Ledger” and the “Trial Balance” tabs to see the effect of the transactions on the account balances.

2. Record adjusting entries on January 31, in the “General Journal” tab (these are shown as items 11–14).

3. Review the adjusted “Trial Balance” as of January 31, 2021, in the “Trial Balance” tab.

4. Prepare a multiple-step income statement for the period ended January 31, 2021, in the “Income Statement” tab.

5. Prepare a classified balance sheet as of January 31, 2021, in the “Balance Sheet” tab.

6. Record closing entries in the “General Journal” tab (these are shown as items 15 and 16).

7. Using the information from the requirements above, complete the “Analysis” tab.

a. Calculate the return on equity for the month of January. If the average return on equity for the industry for January is 2.5%, is the company more or less profitable than other companies in the same industry?

b. How many shares of common stock are outstanding as of January 31, 2018?

c. Calculate earnings per share for the month of January. (To calculate average shares of common stock outstanding take the beginning shares outstanding plus the ending shares outstanding and divide the total by 2.) If earnings per share was $3.60 last year (i.e., an average of $0.30 per month), is earnings per share for January 2018 better or worse than last year’s average?

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their... Par Value

Par value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par,...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas