Tartini Telecom, Inc. files U.S. corporate tax returns and is subject to a 21% income tax rate.

Question:

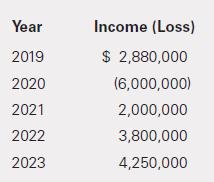

Tartini Telecom, Inc. files U.S. corporate tax returns and is subject to a 21% income tax rate. The company reports no book tax differences. Tartini provides you with the following income information:

Required

a. Prepare the journal entry necessary to record the 2019 income tax provision.

b. Prepare the journal entry necessary to record the 2020 income tax provision.

c. Prepare the journal entries necessary to record the income tax provision for 2021 through 2023.

d. Assuming that a new tax law is enacted on January 2, 2022, lowering the tax rate to 19%. Prepare the journal entries necessary to account for the change in tax law and to record the income tax provision for 2022 and 2023.

Step by Step Answer:

Intermediate Accounting

ISBN: 9780136946694

3rd Edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella