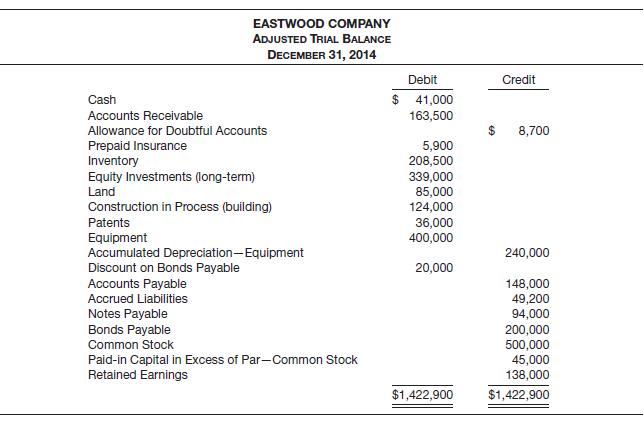

The adjusted trial balance of Eastwood Company and other related information for the year 2014 are presented

Question:

The adjusted trial balance of Eastwood Company and other related information for the year 2014 are presented as follows.

Additional information:

1. The LIFO method of inventory value is used.

2. The cost and fair value of the long-term investments that consist of stocks and bonds is the same.

3. The amount of the Construction in Progress account represents the costs expended to date on a building in the process of construction. (The company rents factory space at the present time.) The land on which the building is being constructed cost $85,000, as shown in the trial balance.

4. The patents were purchased by the company at a cost of $40,000 and are being amortized on a straight-line basis.

5. Of the discount on bonds payable, $2,000 will be amortized in 2015.

6. The notes payable represent bank loans that are secured by long-term investments carried at $120,000. These bank loans are due in 2015.

7. The bonds payable bear interest at 8% payable every December 31, and are due January 1, 2025.

8. 600,000 shares of common stock of a par value of $1 were authorized, of which 500,000 shares were issued and outstanding.

Instructions

Prepare a balance sheet as of December 31, 2014, so that all important information is fully disclosed.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1118147290

15th edition

Authors: Donald E. Kieso, Jerry J. Weygandt, and Terry D. Warfield