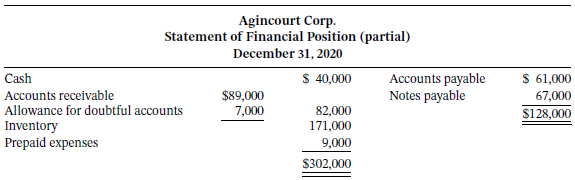

The current assets and current liabilities sections of the statement of financial position of Agincourt Corp. are

Question:

The current assets and current liabilities sections of the statement of financial position of Agincourt Corp. are as follows:

The following errors have been discovered in the corporation?s accounting:

1. January 2021 cash disbursements that were entered as at December 2020 included payments of accounts payable in the amount of $34,300.

2. The inventory balance is based on an inventory count that included $27,000 of merchandise that was received at December 31 but with no purchase invoices received or entered. Of this amount, $10,000 was received on consignment; the remainder was purchased f.o.b. destination.

3. Sales for the first four days of January 2021 in the amount of $30,000 were entered in the sales book as at December 31, 2020. Of these, $21,500 were sales on account and the remainder were cash sales.

4. Cash, not including cash sales, collected in January 2021 and entered as at December 31, 2020, totalled $35,324. Of this amount, $23,800 was received on account; the remainder was proceeds on a bank loan. (The amount owed to the bank for January 2021 was included as part of the Notes Payable account.)

Instructionsa. Adjust (correct) the statement of financial position?s current assets and current liabilities sections.

b. Finance Calculate the current ratio before and after the corrections prepared in part (a). Did the changes improve or worsen this ratio?

c. Calculate the net effect of your adjustments on Agincourt Corp.?s retained earnings balance.

d. Assume that in February 2021, Agincourt approaches its bank for another bank loan, based on its corrected statement of financial position as at December 31, 2020. Also assume that the terms of the new bank loan would require that Agincourt maintain a current ratio of 1.5. As Agincourt?s bank manager, discuss the importance of recording the adjustments above and correcting the statement of financial position as at December 31, 2020.

e. Digging Deeper If the adjustments had not been reflected in the statement of financial position provided to the bank manager, do you think the bank manager would have suspected that the financial statements were incorrect? If so, how would the manager have suspected this misstatement to be the case?

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 978-1119496496

12th Canadian edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy