The following list of balances has been extracted from the records of company cowgale co as of 31 October 2017 the end of the most

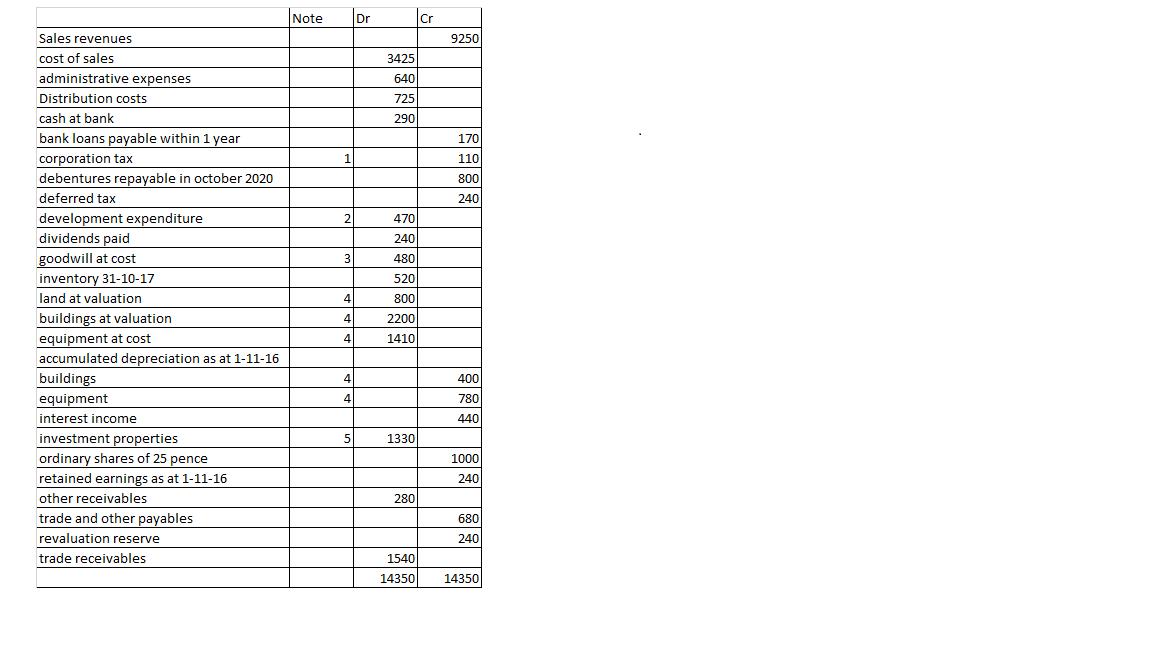

The following list of balances has been extracted from the records of company cowgale co as of 31 October 2017 the end of the most recent financial year.

Notes

1. The balance on the corporation tax account represents an overprovision for corporation tax for the financial year ended 31 October 2016 corporation tax for the year ended October 31 2017 is estimated at 600.000

2. the balance on development expenditure as of 31 October 2017 consists of:120.000 spent during the year on training staff for a call center. Due to social unrest, the plan was canceled. 350.000 spent during the year to make the packaging of products cheaper and more efficient. The new process will be introduced in January 2018

3. Goodwill arose from the acquisition of another business in 2010 the fair value of goodwill as of October 31 2017 is estimated at 350.000

4. the depreciation policy is:

Land no depreciation

Building 5% straight light

Equipment 30% reducing balance basis

Depreciation has not been charged for the year yet. It is considered part of administrative costs.

Cowgale uses the revaluation method for land and buildings. Estimates of the fair values as of 31 October 2017 are 880.000 for land and 1600000 for buildings. The building had previously been revalued upwards by 200000

5.cowgale uses the fair value model for investment properties. The market value of the investment properties as of October 31 2017 was estimated at 1.400.000

6.cowgale vacated some office property it was leasing under an operating lease on august 1st 2017,cowgale was committed to making further payments totaling 108.00 until July 2018. This has not yet been accounted for.

- Required

- Prepare a statement of comprehensive income for the year ended 31 October 2017. Show all workings

Sales revenues cost of sales administrative expenses Distribution costs cash at bank bank loans payable within 1 year corporation tax debentures repayable in october 2020 deferred tax development expenditure dividends paid goodwill at cost inventory 31-10-17 land at valuation buildings at valuation equipment at cost accumulated depreciation as at 1-11-16 buildings equipment interest income investment properties ordinary shares of 25 pence retained earnings as at 1-11-16 other receivables trade and other payables revaluation reserve trade receivables Note 1 2 3 4 4 4 4 4 5 Dr 3425 640 725 290 470 240 480 520 800 2200 1410 1330 280 1540 14350 Cr 9250 170 110 800 240 400 780 440 1000 240 680 240 14350

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Statement of comprehensive income for the year ended 31 October 2017 sales revenues 9250 cost of s... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards